Many buyers are getting sticker shock in this year's hot real estate market. They're realizing they can't get the home they were hoping for within their original budget. Some buyers are dropping out due to rising prices. Others are adjusting their expectations about the market and moving forward with their home-buying plan. They're doing this by "living in their payment, not their mortgage".

Living in your Payment

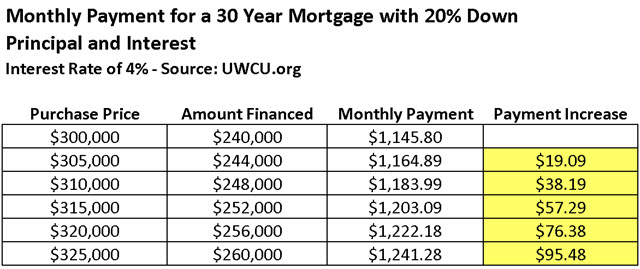

"Living in your payment" refers to looking at your purchase in terms of your monthly payment, not the purchase price of your home. For example, suppose your original budget for buying a home was $300,000, but due to rising prices you're considering increasing your budget in order to find the right property. The chart below shows for every $5,000 increase in purchase price, the monthly payment increases by just over $19. A $25,000 increase in purchase price amounts to a monthly payment increase of only $95.48.

Many buyers who look at their purchase from this perspective realize they can comfortably afford a higher purchase price without breaking their monthly budget.

"But what if the market crashes? By paying more am I taking on too much risk? "

This is a great question and one we get a lot. The short answer is the market isn't likely to crash in Madison due to a large pent up demand for housing and a shortage of supply. As we wrote earlier this year, the new normal for Madison real estate is low supply and rising prices. Below are a few reasons why we expect this to be the case for the foreseeable future.

Why a Real Estate Crash Isn't Likely in Madison

- A tight apartment market with high rents will continue to motivate tenants to stop paying rent and start building equity. Home ownership will be a strong motivator for as long as the apartment market remains tight.

- Home building is low by historical standards and is not enough to satisfy the demand for housing.

- New condo construction is extremely low. There's a very large pent up demand for condominium housing, but very few new construction condos are being built to address it.

- Foreclosures are low by historical standards and are no longer a significant source of inventory.

Every Situation is Unique

Whether you're a first-time or repeat buyer, we can help you successfully navigate this low supply market. Contact us at your convenience. Share your goals with us, and we'll share some ideas that will help you reach them.