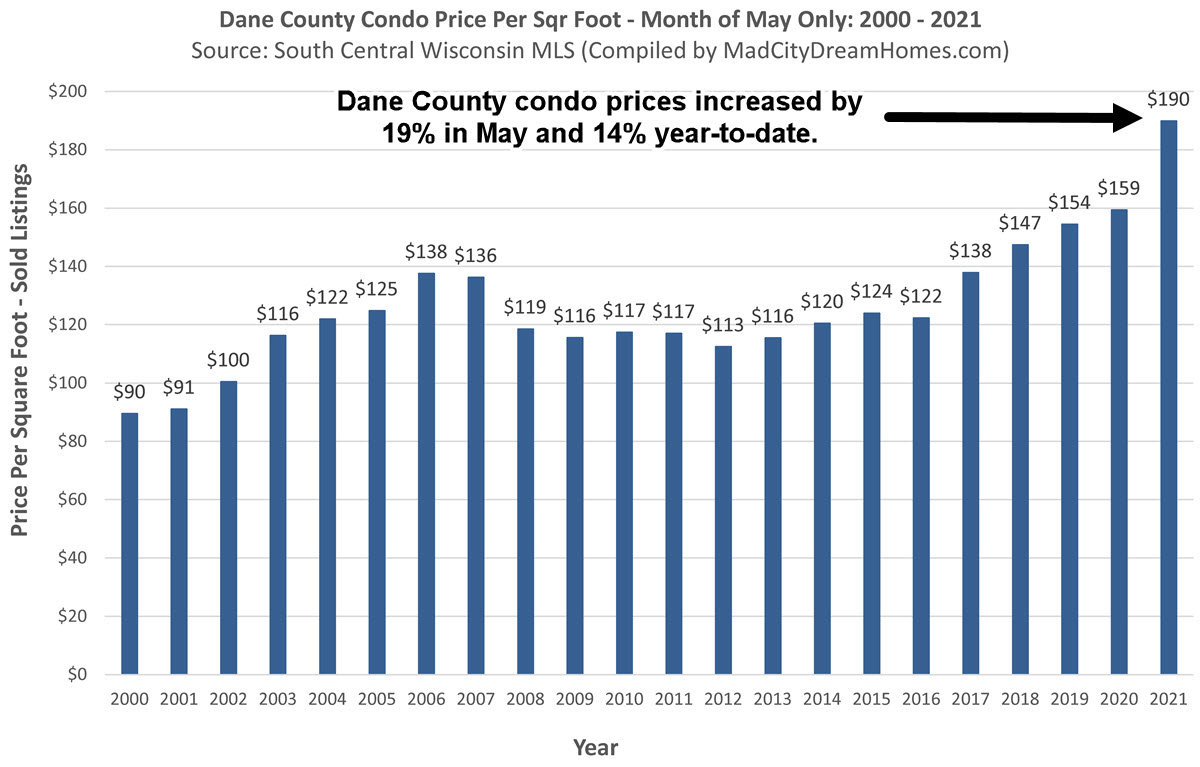

Low appraisals have become more common in the Madison area due to home and condo prices rising at an accelerated pace. If you're planning to sell your home soon, you should know this year's market can be tricky, because a low appraisal can potentially sidetrack your transaction, resulting in either a negotiated price reduction or even a canceled offer.

Fortunately there are a few things you can do to protect your listing from appraisal issues. Below we share 7 ways you and your real estate agent can work together to prevent a bad appraisal from derailing your listing.

7 ways to protect your listing from a low appraisal

- Choose a listing plan that's designed to attract multiple offers. Your odds of receiving an offer with no appraisal

While every real estate situation is unique, our team has noticed that sellers often view offers from buyers more favorably if they’re working with a local lender -- especially someone who takes the time to vouch for them. Even if your offer isn’t the highest or it includes financing or has other contingencies, having a local lender as part of the transaction can help distinguish your offer in a competitive market. Online or out-of-state lenders can cause listing agents to worry about appraisers, communication, and accountability. Sellers want a smooth closing, and a local, knowledgeable, and service-minded mortgage lender can help pave that path early on.

While every real estate situation is unique, our team has noticed that sellers often view offers from buyers more favorably if they’re working with a local lender -- especially someone who takes the time to vouch for them. Even if your offer isn’t the highest or it includes financing or has other contingencies, having a local lender as part of the transaction can help distinguish your offer in a competitive market. Online or out-of-state lenders can cause listing agents to worry about appraisers, communication, and accountability. Sellers want a smooth closing, and a local, knowledgeable, and service-minded mortgage lender can help pave that path early on.