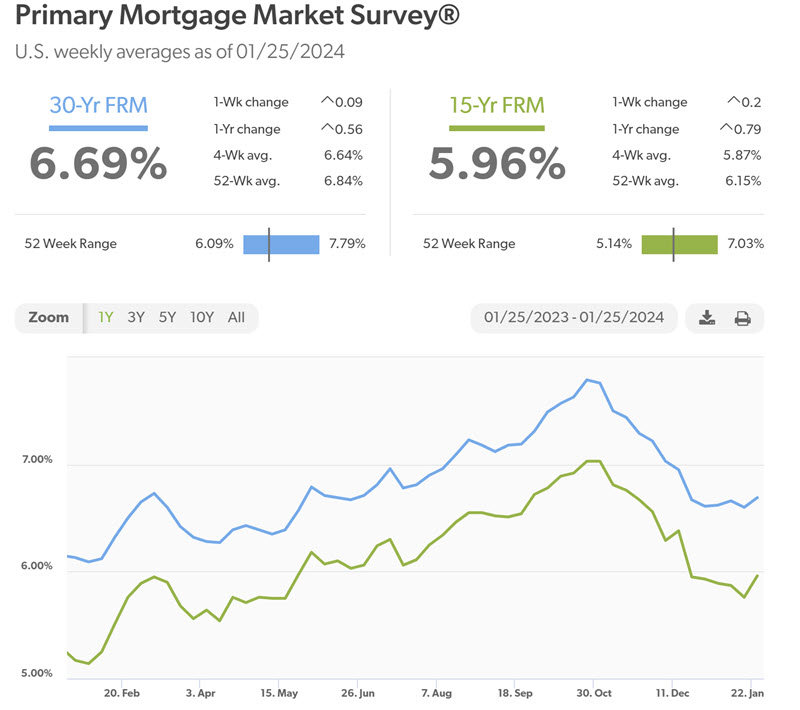

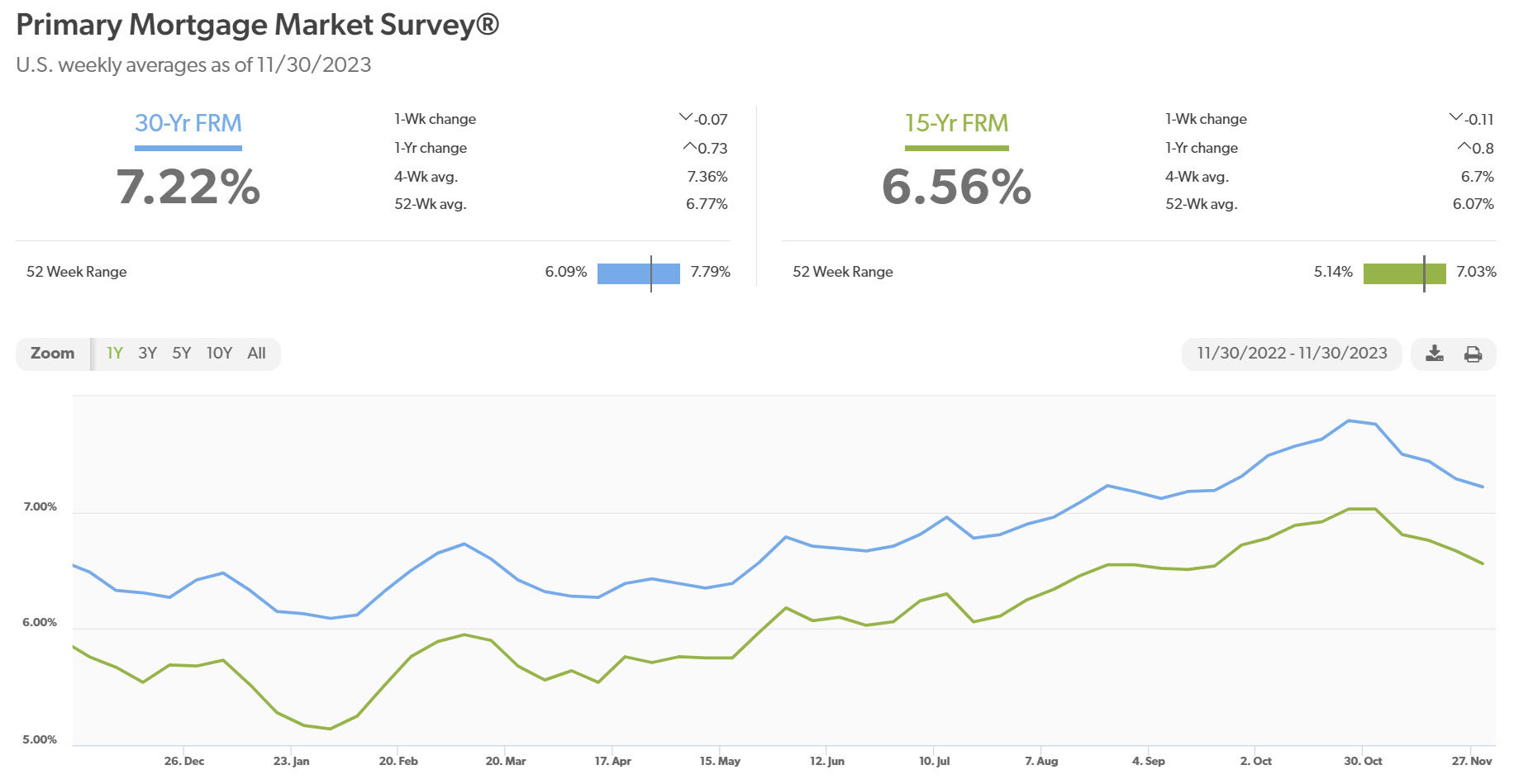

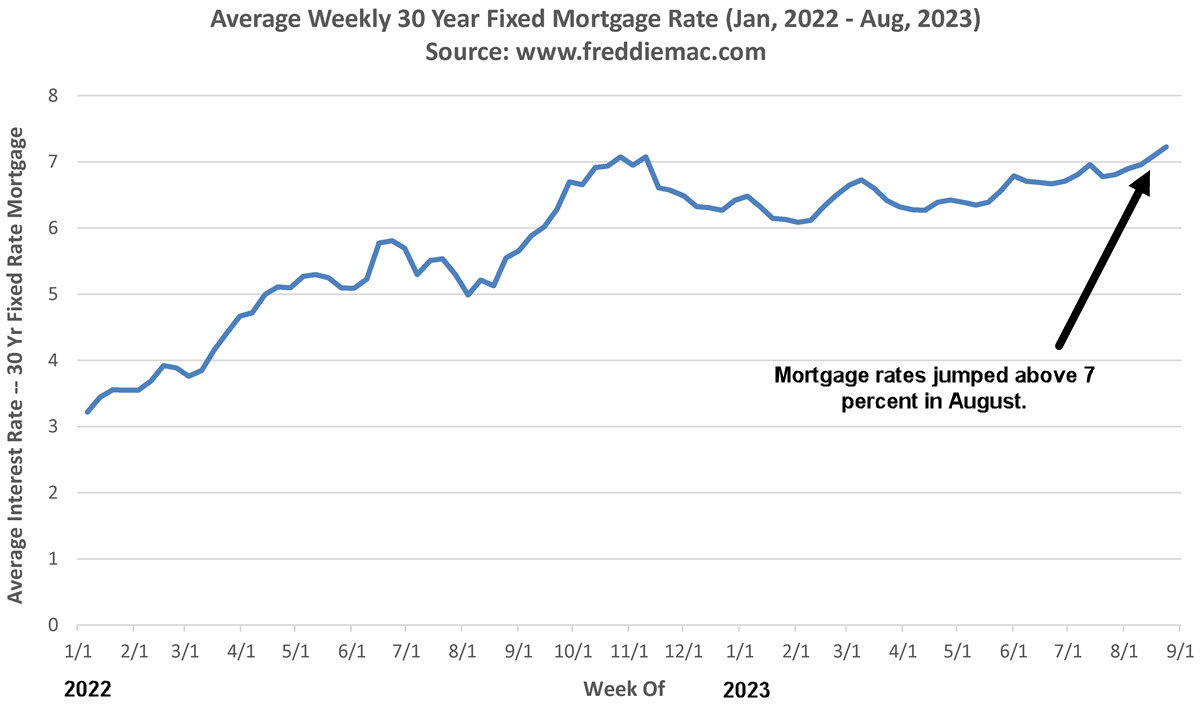

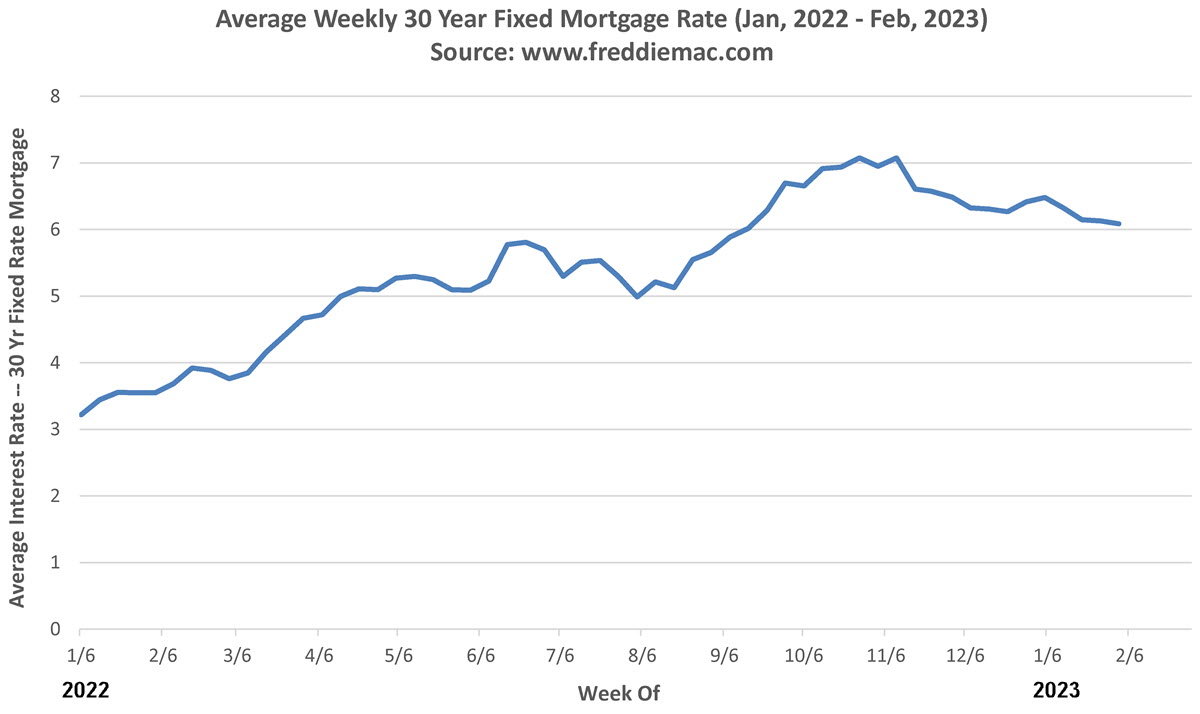

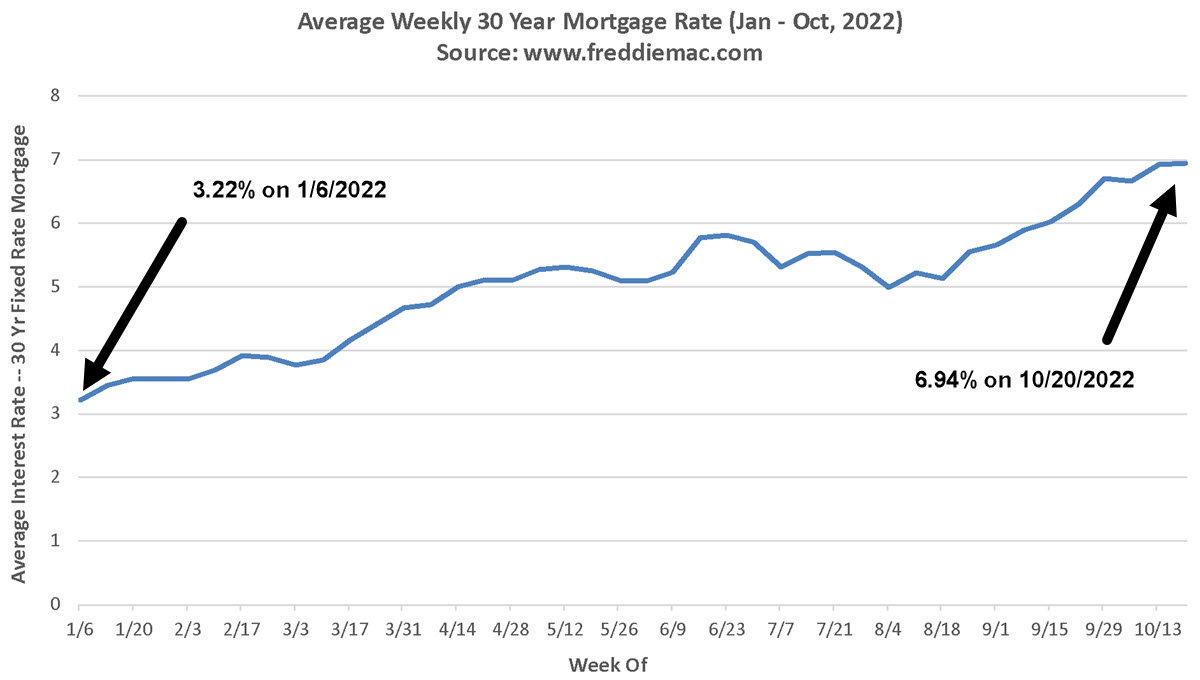

Rates for a 30 year mortgage were approaching 8 percent just a few months ago, but now they're much closer to 6.5%. What new possibilities do lower rates create for you? Now is a great time to explore your opportunities with a trusted local lender. Contact your Mad City Dream Homes realtor for a referral to a lender who will help you understand your options and make good financial decisions. We'd love to help.

Chart and data are provided courtesy of the Freddie Mac Primary Mortgage Market Survey.

While every real estate situation is unique, our team has noticed that sellers often view offers from buyers more favorably if they’re working with a local lender -- especially someone who takes the time to vouch for them. Even if your offer isn’t the highest or it includes financing or has other contingencies, having a local lender as part of the transaction can help distinguish your offer in a competitive market. Online or out-of-state lenders can cause listing agents to worry about appraisers, communication, and accountability. Sellers want a smooth closing, and a local, knowledgeable, and service-minded mortgage lender can help pave that path early on.

While every real estate situation is unique, our team has noticed that sellers often view offers from buyers more favorably if they’re working with a local lender -- especially someone who takes the time to vouch for them. Even if your offer isn’t the highest or it includes financing or has other contingencies, having a local lender as part of the transaction can help distinguish your offer in a competitive market. Online or out-of-state lenders can cause listing agents to worry about appraisers, communication, and accountability. Sellers want a smooth closing, and a local, knowledgeable, and service-minded mortgage lender can help pave that path early on.