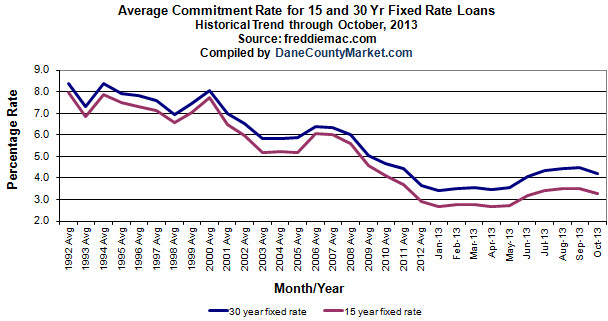

Although Madison mortgage rates rose in May of this year from rock bottom levels, rates continue to trend in a favorable direction for anyone thinking of buying or refinancing a home.

Mortgage Rates from a Historical Point of View

This data from Freddie Mac trends mortgage rates dating back to 1992. Mortgage rates for 30 year fixed rate loans are currently well below 4.5%, putting current rates among the lowest for any time period in the last 22 years.

View Madison WI Mortgage Rates Updated Daily

Great Midwest Bank publishes its mortgage rates daily and online here. Looking to closely monitor rates? Sign up for the Great Midwest Bank mortgage rate watch.

Upcoming Changes in the Mortgage Market

Mortgage underwriting guidelines will

…

Buying a home in the Madison area and in need of a loan? We've worked with hundreds of buyers over the years, and we've collected their feedback about the lenders who assist them with their mortgages. Over time we've developed a network of service-oriented lenders who are universally loved by their clients for their exceptional service. Each of these lenders has different strengths and areas of expertise, so we're happy to refer you to a lender who is a good match for you and your specific situation. Just let us know how we can help!

Buying a home in the Madison area and in need of a loan? We've worked with hundreds of buyers over the years, and we've collected their feedback about the lenders who assist them with their mortgages. Over time we've developed a network of service-oriented lenders who are universally loved by their clients for their exceptional service. Each of these lenders has different strengths and areas of expertise, so we're happy to refer you to a lender who is a good match for you and your specific situation. Just let us know how we can help!