Madison mortgage rates have been falling, even though they are predicted to rise above 5% in 2019. As of this post, the rate for a 30 year fixed rate loan in Madison is below 4.5%. For a look at current local rates, contact our friends at Great Midwest Bank and Johnson Bank.

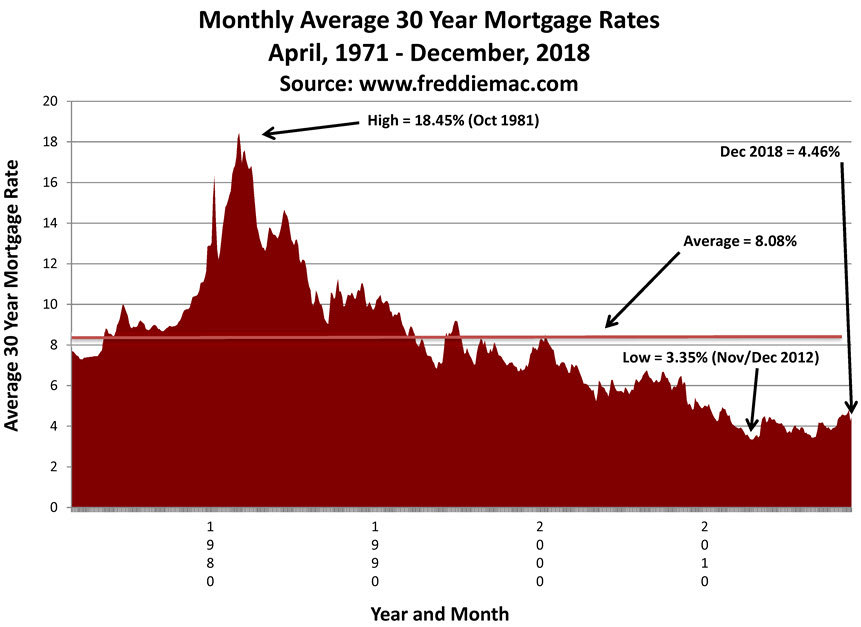

Even when rates do rise above 5%, they'll remain attractive when compared to rates over the last few decades. For example, take a look at the graph below, which shows the average 30 year mortgage rate dating back to April, 1971. Over this time period the average rate for a 30 year fixed rate loan has been above 8%, which is far above current rates.

Tips for buyers and sellers while rates are under 5%

If you've been thinking of buying later in 2019, we recommend you start working on your goals right now. Today's lower rates could help you achieve a lower monthly payment when you find the perfect home.

If you've been thinking of selling later this year, now is the time to prepare for a successful listing. The hot spring market is right around the corner, and it's likely to be filled with buyers who are looking to take advantage of rates while they're below 5%.

Whether you plan to buy, sell, or both, we're here to help you successfully navigate the 2019 market. Contact us for a short consultation. We'll be happy to meet with you at your home, at our office, a coffee shop, or any other location that's convenient to you.