In the past few months we've been sharing some of the key trends impacting supply and demand for Dane County real estate. Here's a quick recap:

On the demand side

We see plenty of strength in the years ahead for two key reasons:

- The millennial generation, America's largest, is aging into its prime years for homeownership.

- Dane County is the fastest growing region in the state, and we expect many more people will continue to move here for reputation, quality of life, economic, and climate-related reasons.

On the supply side

We see two big trends at play that will continue to limit inventory and support higher prices:

- Foreclosures are occurring near historically low levels, and we expect distressed sales to remain low for the foreseeable future.

- New construction, although currently above historic lows, isn't sufficient to meet the demand for homes and condos.

There's one other key trend that will limit supply and elevate prices.

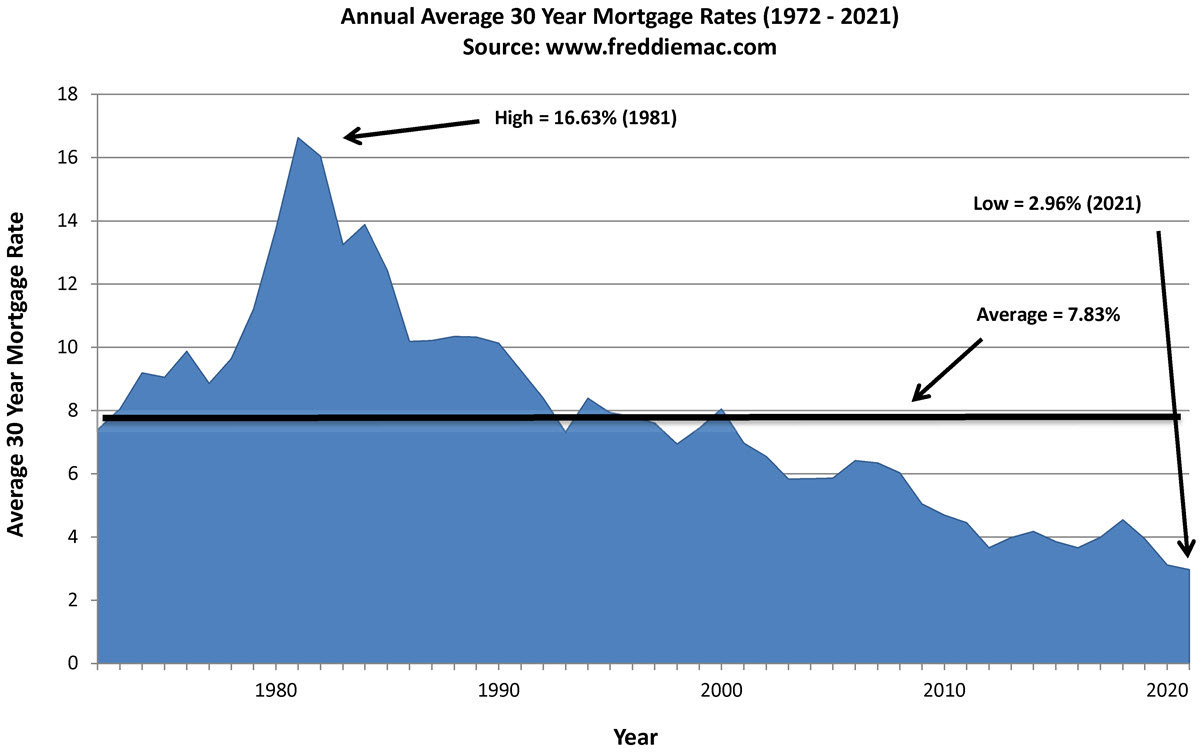

And that is our prolonged, ten-year period of historically low interest rates. For a little context, take a look at the chart below, which shows the average annual interest rate for a 30-year mortgage over the last 5 decades.

The impact of prolonged, historically low rates

In 8 of the last 10 years, the average 30-year mortgage rate has been less than 4%, with rates bottoming out and dropping to less than 3% in 2021. What this means is that for the last 10 years, homeowners and investors have been acquiring real estate under very favorable terms, and refinancing at even better terms when rates have dipped lower. Now that interest rates are rising again, many property owners will be reluctant to sell when they're currently enjoying such low, monthly payments.

Putting all of these trends together

We see consistently low levels of supply and strong prices for many years to come. Yes, there will be a time when prices adjust. But in the long run (because of consistently low supply) we believe those who continue to own real estate will be those who build wealth.

Do you need help getting into the real estate game and building your wealth?

Right now, the recipe for building wealth is all about finding the property that checks most of your boxes, not all of them. By paying down the principal on your mortgage, by taking good care of your home, and by tending to your home's appreciation over the long run, you can start building equity right now that will help you move up to your next home a few years down the line.

To learn more about buying a home, condo or investment property in our low supply market, please reach out to our agent team for a helpful consultation. Our team approach to buyer representation is working wonders for our clients in 2022, and we'd love to work with you on your homeownership goals, too. Just like you, we are in the real estate game for the long run.