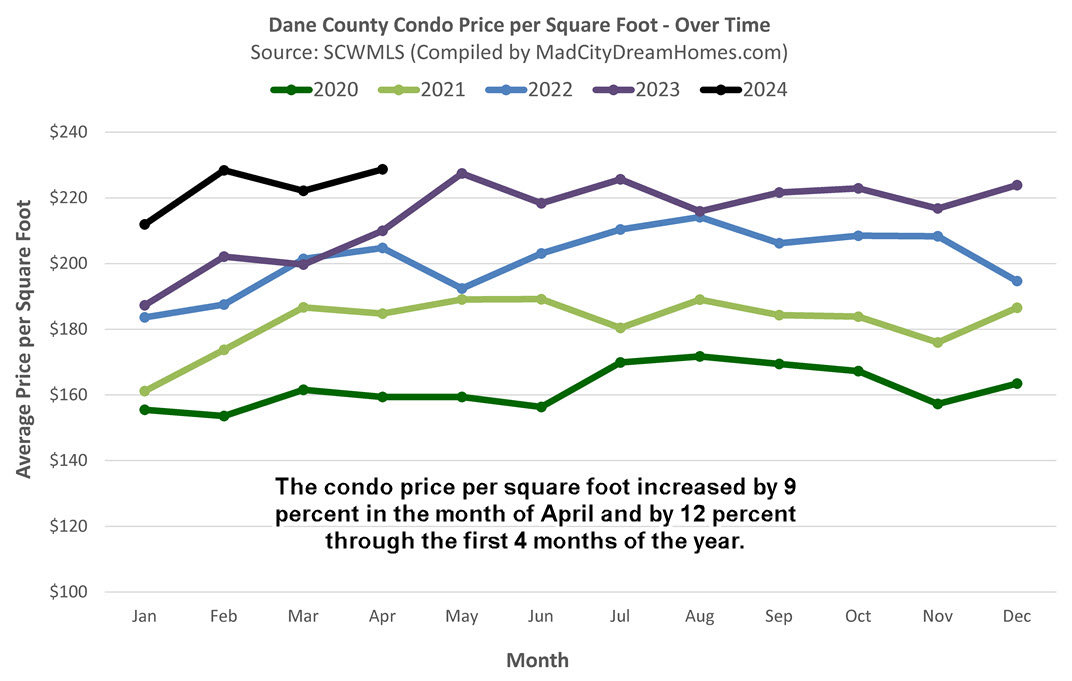

Madison area condo prices continued to move higher in the month of April. Here's our latest update on the Dane County condo market.

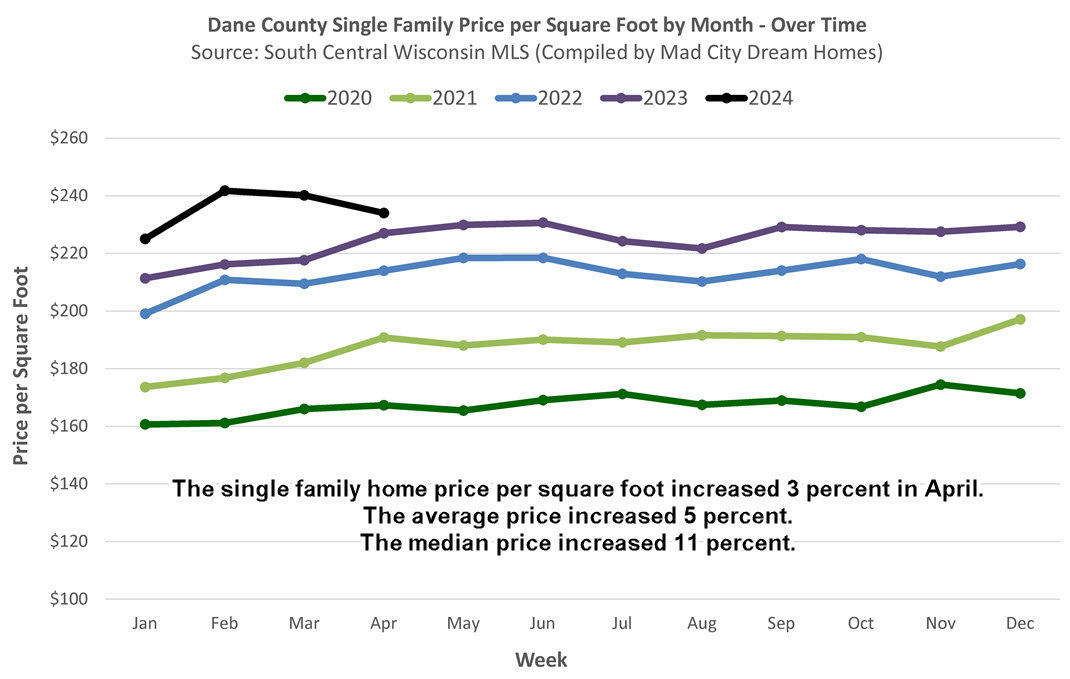

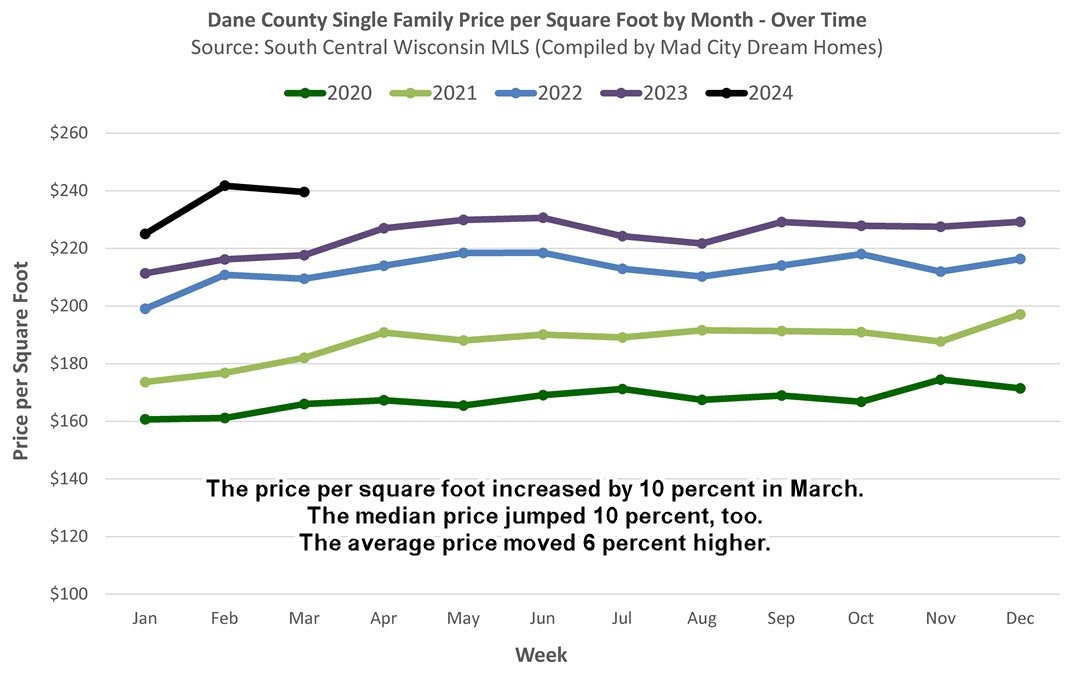

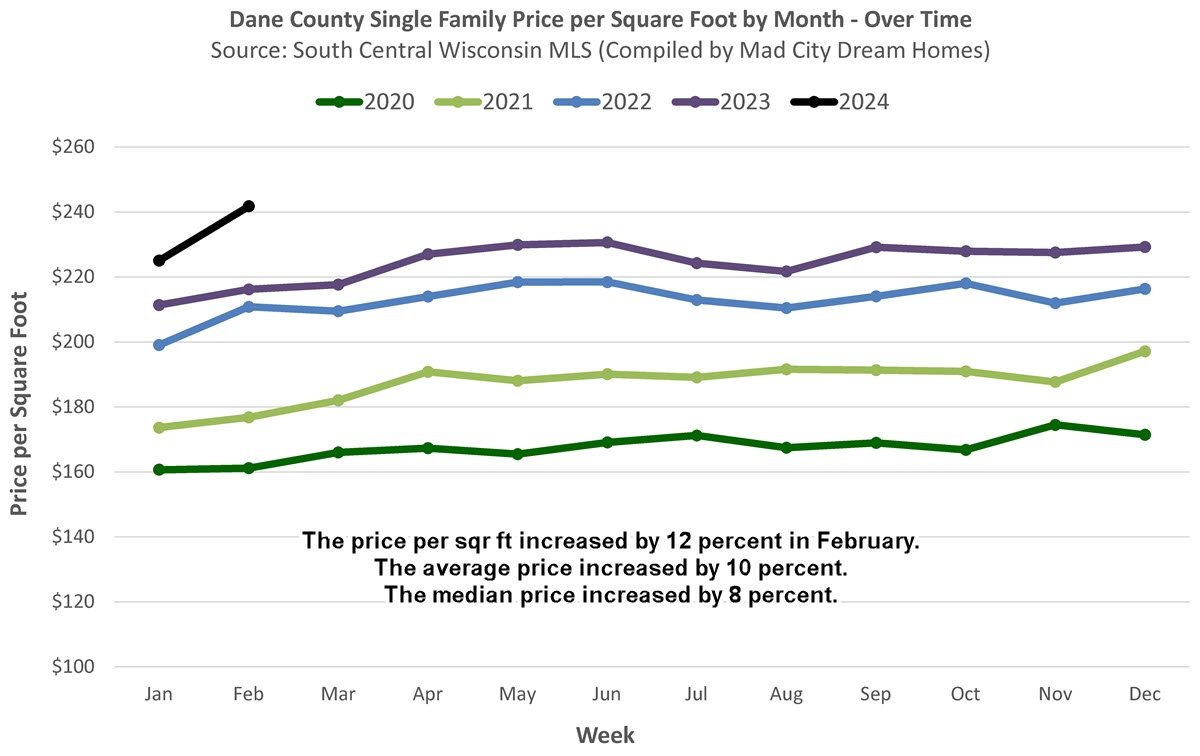

Dane County condo prices

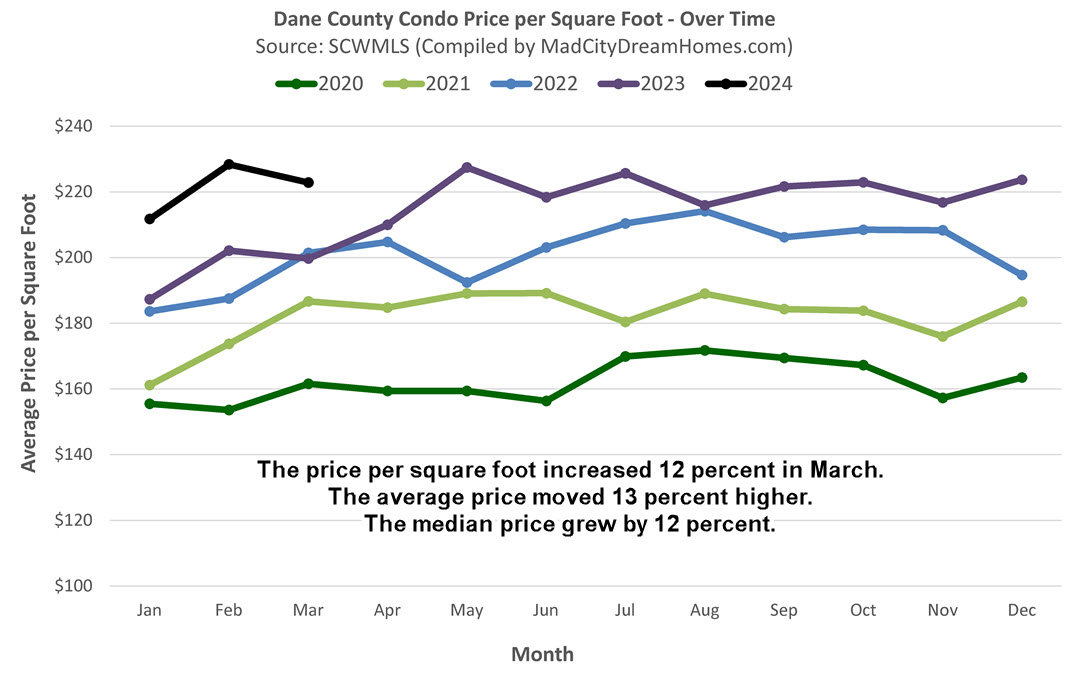

The price per square foot increased from $210 in April of 2023 to $229 in April of 2024. That's a 9 percent increase year-over-year. Through the first 4 months of the year, the price per square foot is up 12 percent.

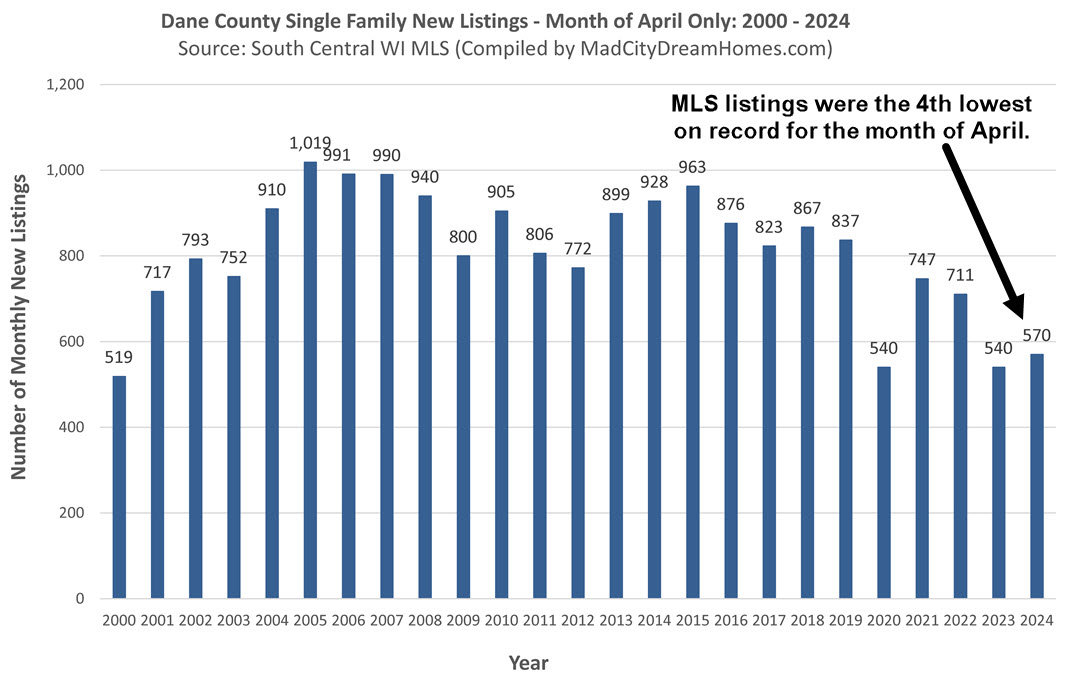

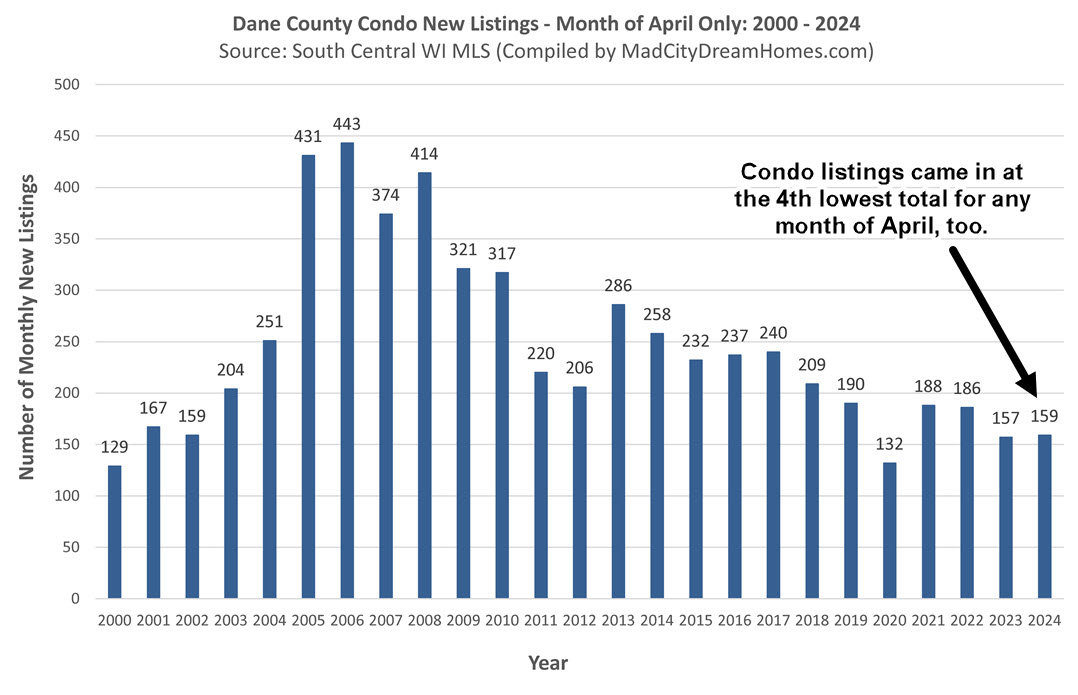

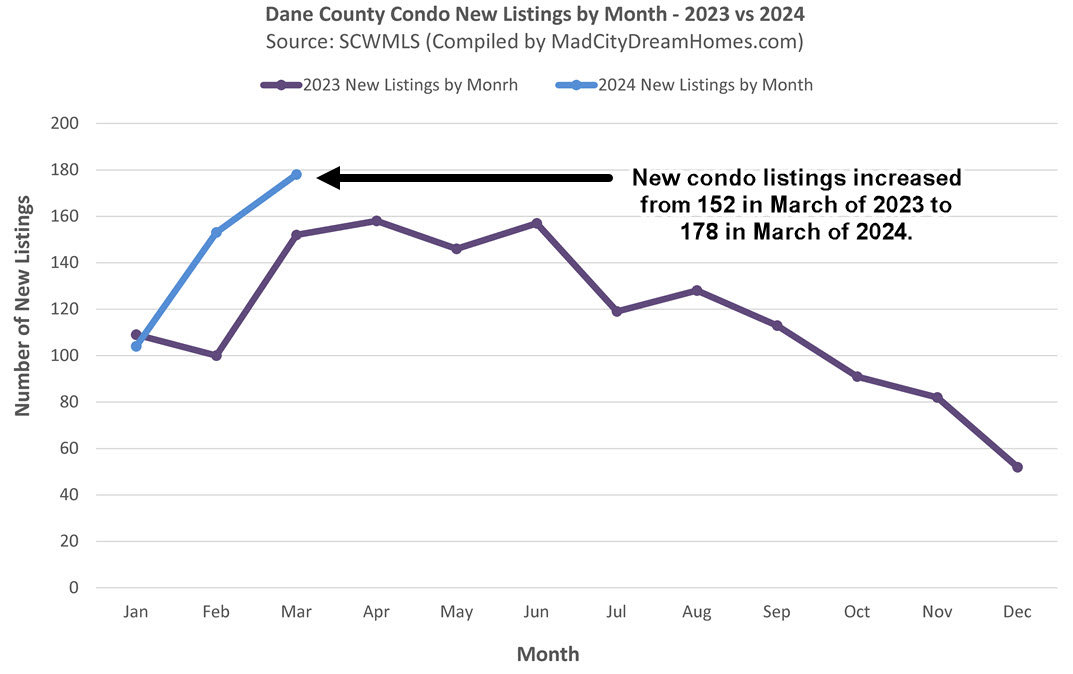

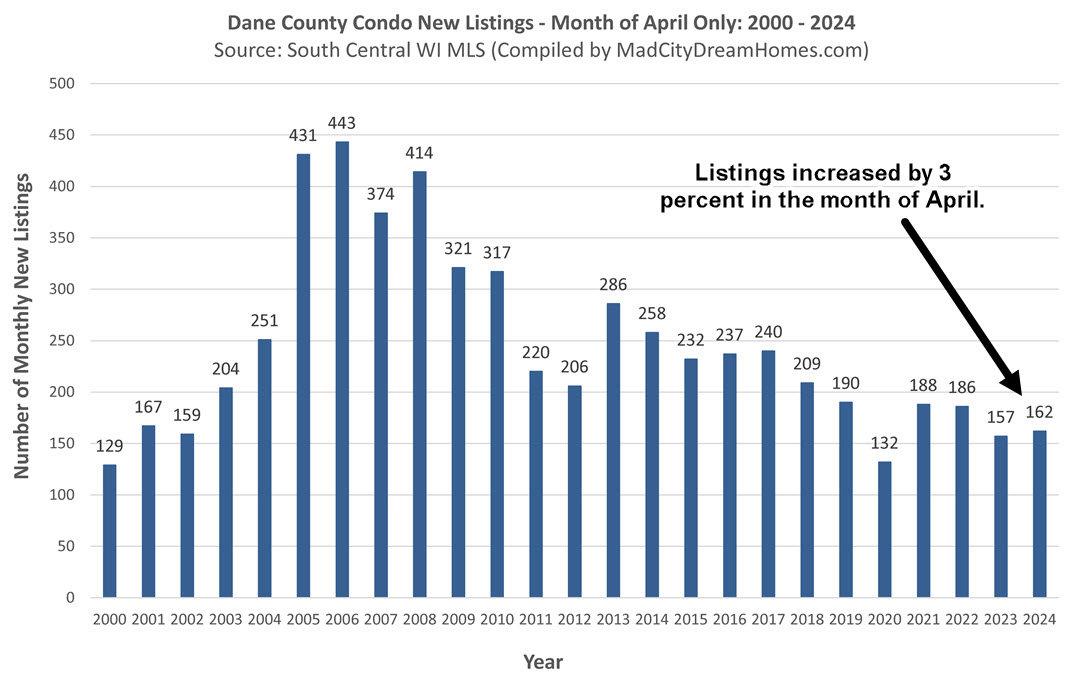

MLS condo listings

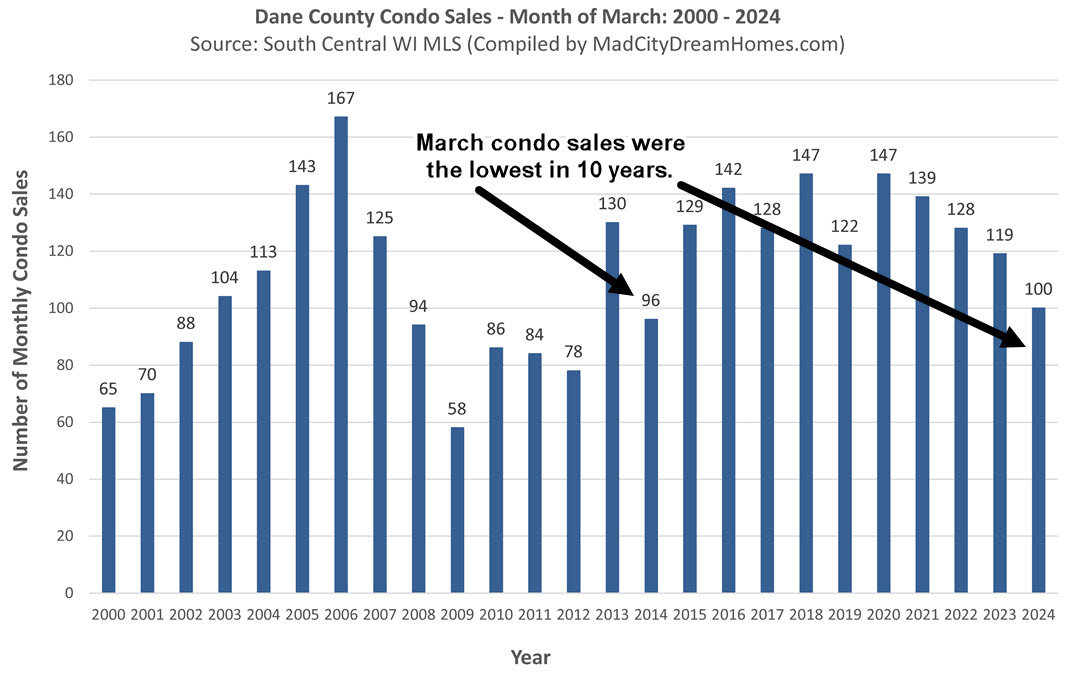

New condo listings edged higher in the month of April, and are up by 15 percent through the first 4 months of the year. In the bigger picture, listing activity remains low compared to most other years this century.

Accepted offers

A few more condos went under contract in the month of April, but were low compared to most other years dating

…