Mortgage Rate Trends:

March, 2019

Mortgage rates in Madison follow the trends at the national level. One great source for tracking 15 year and 30 year rates is the primary mortgage market survey published by Freddie Mac. Freddie Mac conducts weekly surveys to determine the average weekly, monthly and annual mortgage rates across the country.

We've compiled the Freddie Mac data below to show how 15 year and 30 year mortgage rates have changed over time. As the data below shows, rates have risen but remain low by historic standards.

View Madison mortgage rates updated daily courtesy of Great Midwest Bank and Johnson Financial Group.

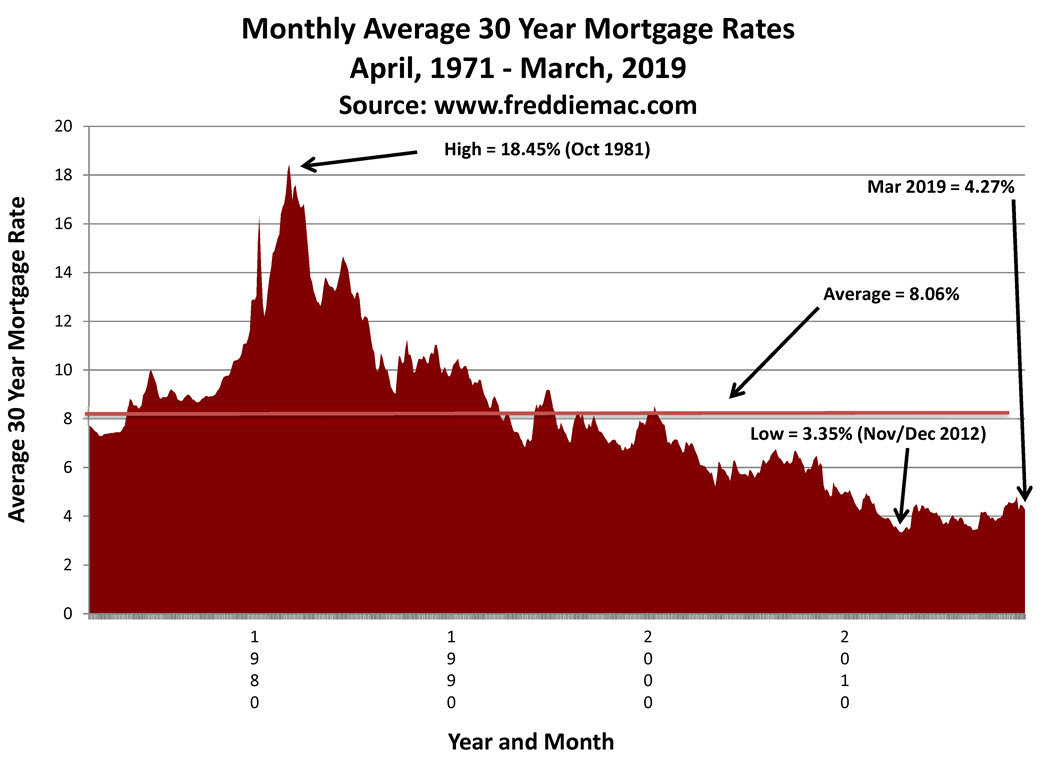

30 Year Mortgage Rates - Mar, 2019

The average 30 year mortgage rate for the month of March was 4.27%. The graph below shows how the monthly average has trended from June, 1971 to March, 2019. The month with the highest rate on record was October 1981, when the average was 18.45%. November and December of 2012 had the lowest average rate on record: 3.35%. As the graph below shows, 30 year rates are currently trending well below the historical average of 8.06%. Rates dropped noticeably at the end of March.

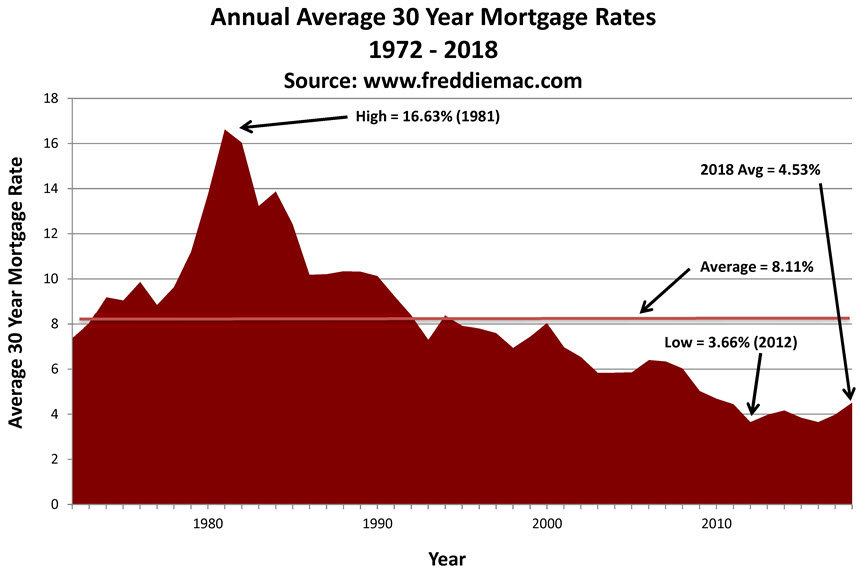

30 Year Mortgage Rates: 1972 -2018

The graph below shows how the annual average has trended from 1972 to 2018. The average 30 year mortgage rate in 2018 was 4.53%. This was well below the historic average of 8.11%.

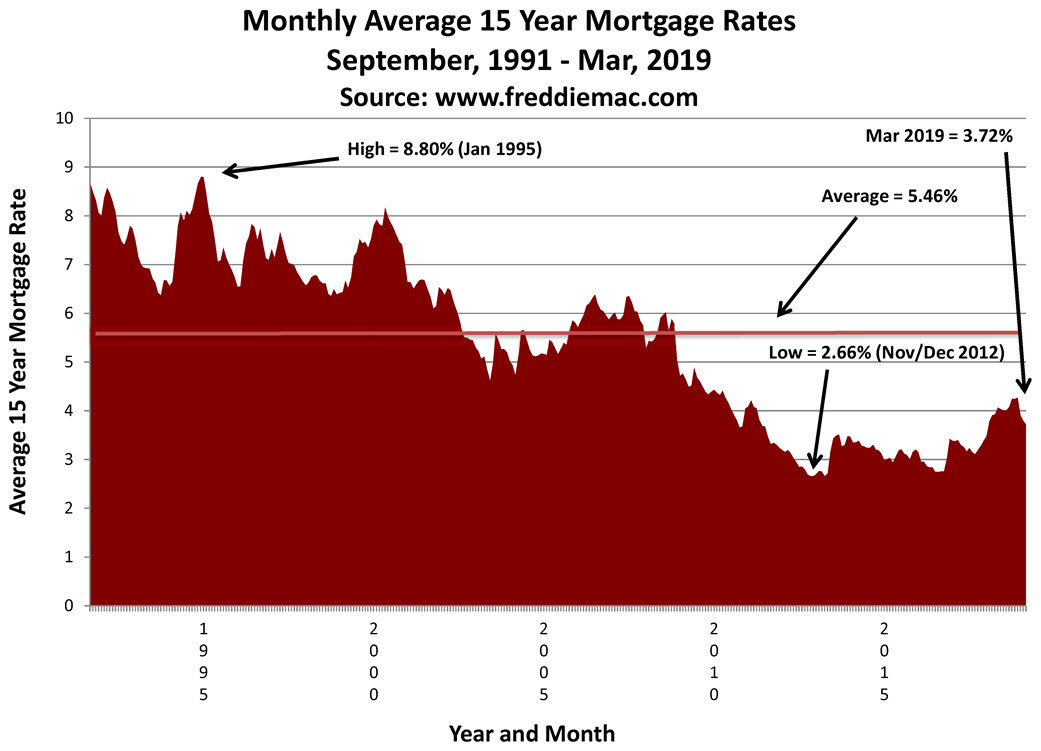

15 Year Mortgage Rates - March, 2019

The average 15 year mortgage rate for the month of March was 3.72%. The Freddie Mac data for 15 year rates goes back to September, 1991. The graph below shows the month with the highest rate on record was January, 1995, when the average was 8.80%. November and December of 2012 had the lowest average rate on record: 2.66%. Fifteen year rates are trending well below the historical average of 5.46%, and dropped noticeably at the end of March.

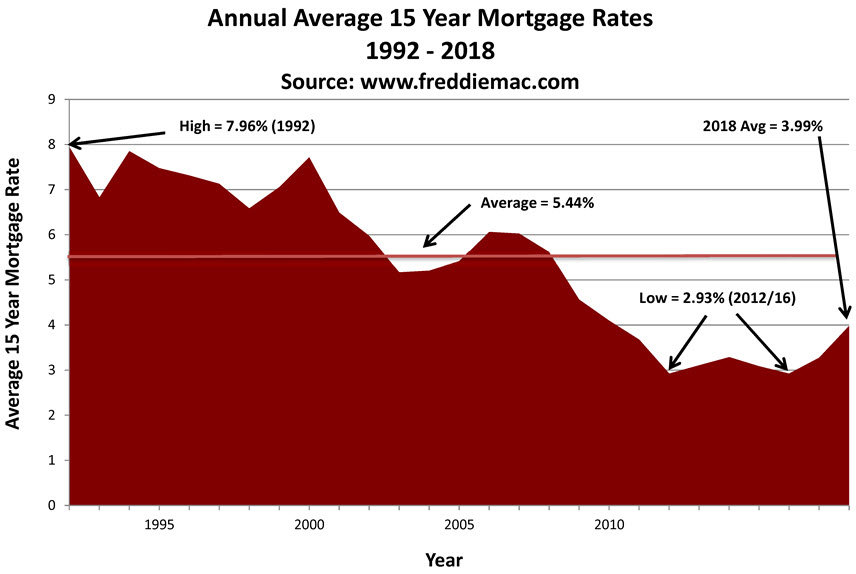

15 Year Mortgage Rates: 1992 - 2018

The graph below shows how the annual average has trended from 1992 to 2018. The average 15 year mortgage rate in 2018 was 3.99%. This was well below the historic average of 5.44%.

More Market Reports

Check out our market report home page for our full suite of real estate reports. For questions about your local market, please contact Dan Miller.