Multifamily Real Estate Trends:

May, 2020

The report below covers the latest trends for income properties in Madison and Dane County, Wisconsin. Our report covers gross rent multiplier, price, sales, inventory, days on market, and other trends in the multifamily real estate market. All data comes from the South Central Wisconsin MLS database. Below is a snapshot for our May, 2020 report.

View all listed Madison area income properties for sale here.

Dane County Multifamily Real Estate Overview

- The Madison area gross rent multiplier through May is near historic highs.

- The multifamily average price per unit reached a new high through May, 2020.

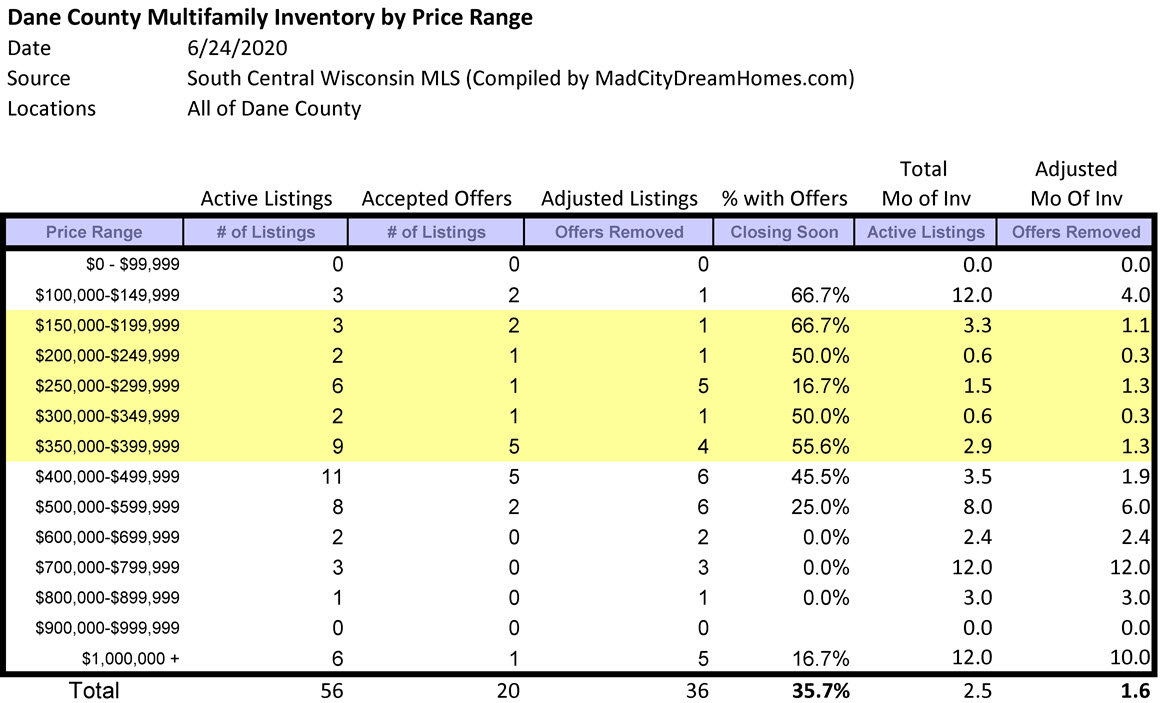

- Only 1.6 months of income property supply are available for sale on the MLS. as of June 24th, 2020. This low level of supply is helping to push local GRMs and local prices higher.

- Multifamily sales have dropped this year because fewer properties are being listed for sale. Sales through May are well below the levels from last year.

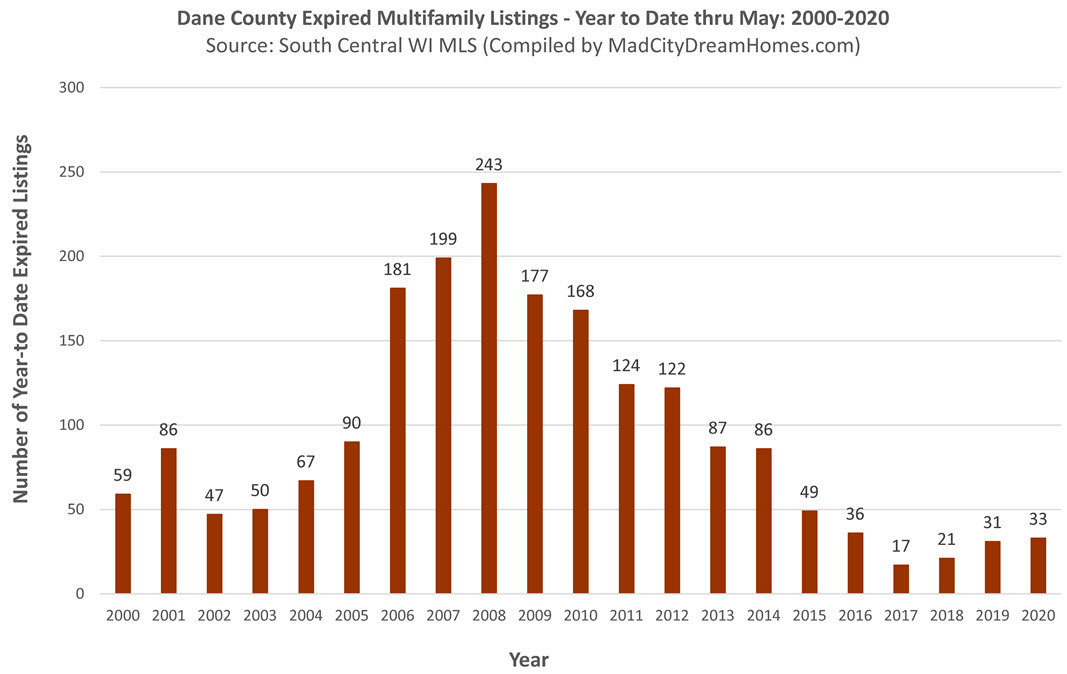

- Expired listings are beginning to rise but are still trending near record lows through the month of May.

- The rental property listing expiration rate has risen above historic lows. COVID-19 has caused some sellers to pull their listing from the market.

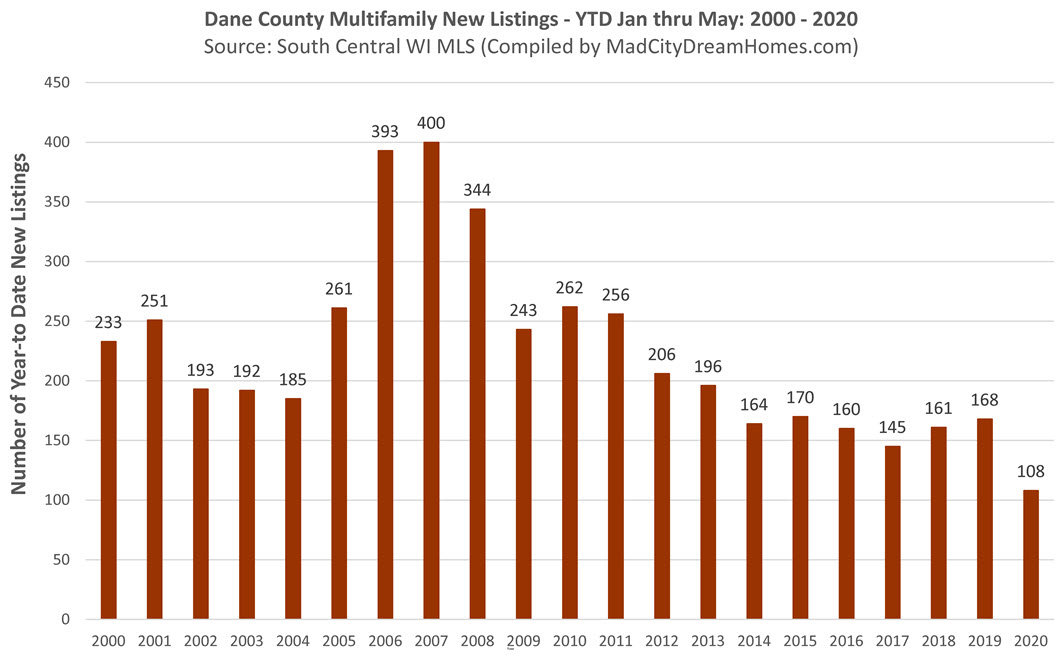

- New multifamily listings continue to enter the market at a very slow pace through the month of May.

- Days on market for investment properties are beginning to rise - but remain low compared to most other years in the recent past.

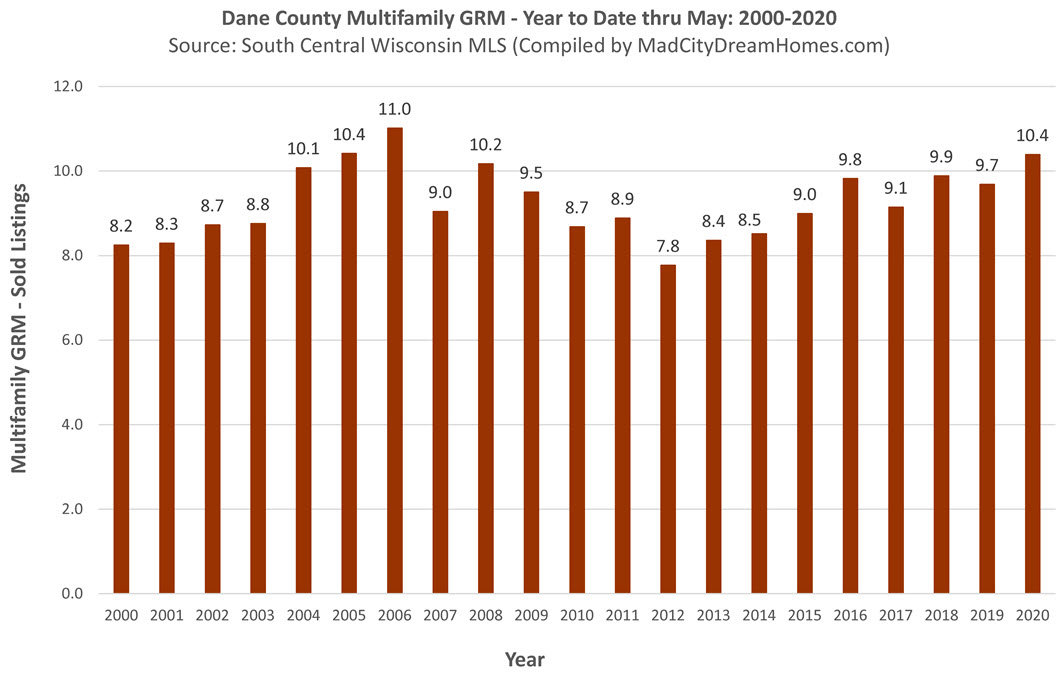

Dane County Gross Rent Multiplier - May, 2020

The gross rent multiplier (GRM) measures a rental property's sales price relative to its income producing potential (sales price/gross annual income). A market with low GRMs indicates an environment where investors can purchase at good values. A market with rising GRMs indicates one where properties are becoming more expensive.

Madison area gross rent multipliers have been trending higher after bottoming out in 2012. The average GRM through the month of May was 10.4, an historically high number. Low supply and high demand have been pushing local prices and local GRMs higher.

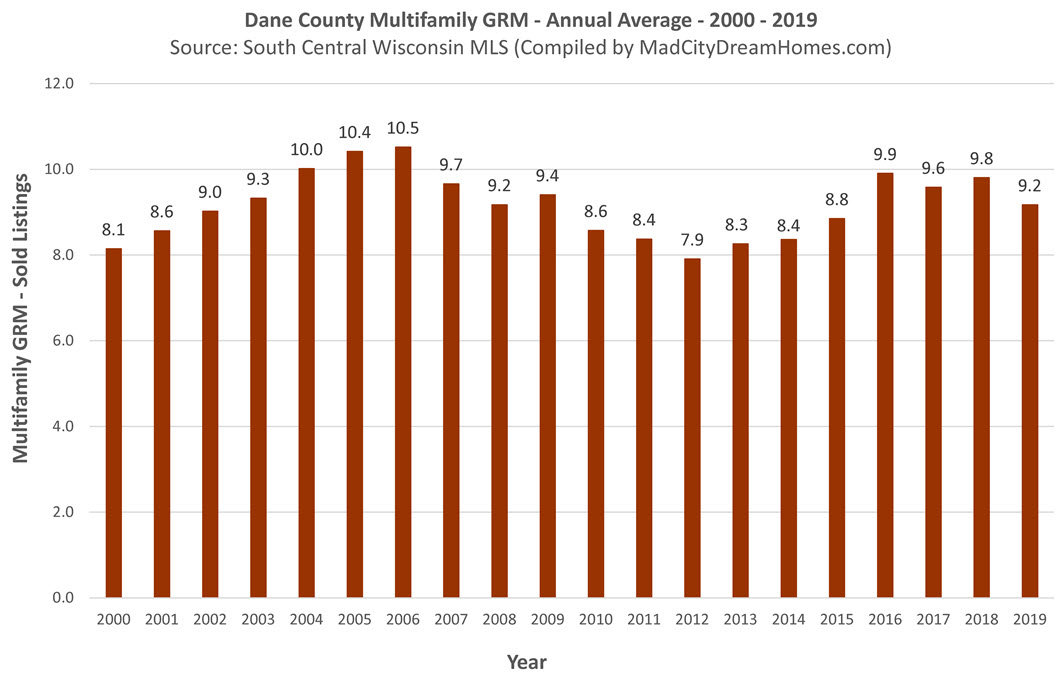

On an annual basis, the Dane County GRM ended the 2019 year at 9.2.

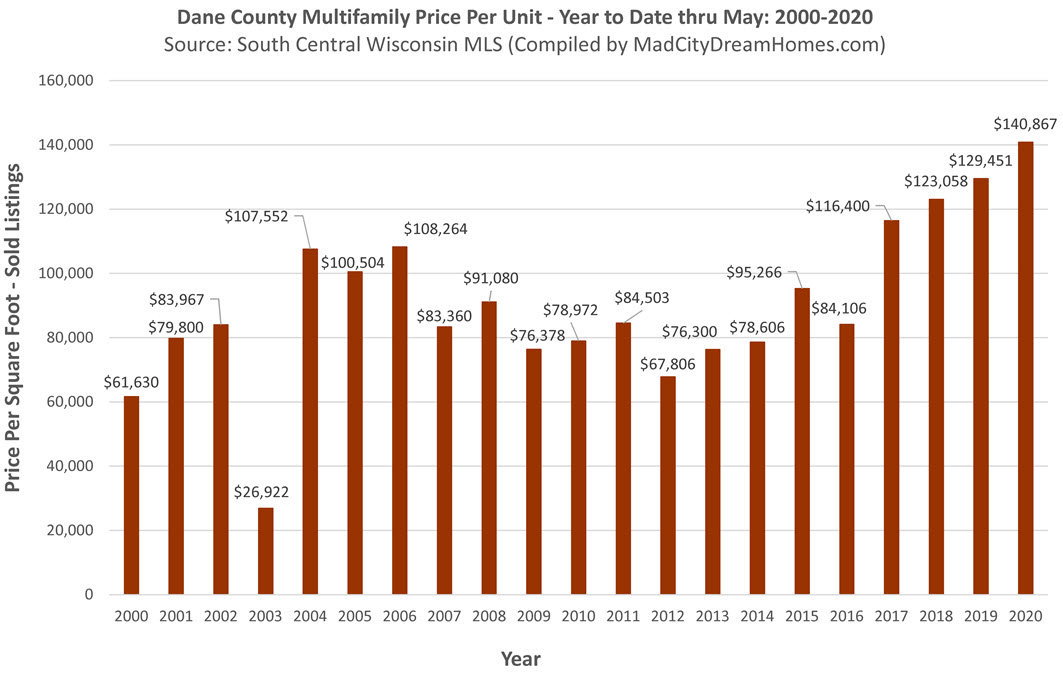

Multifamily Average Price per Unit - May, 2020

The Dane County income property price per unit has been trending higher. Year-to-date through May, the average price per multifamily unit is $140,867 - the highest on record.

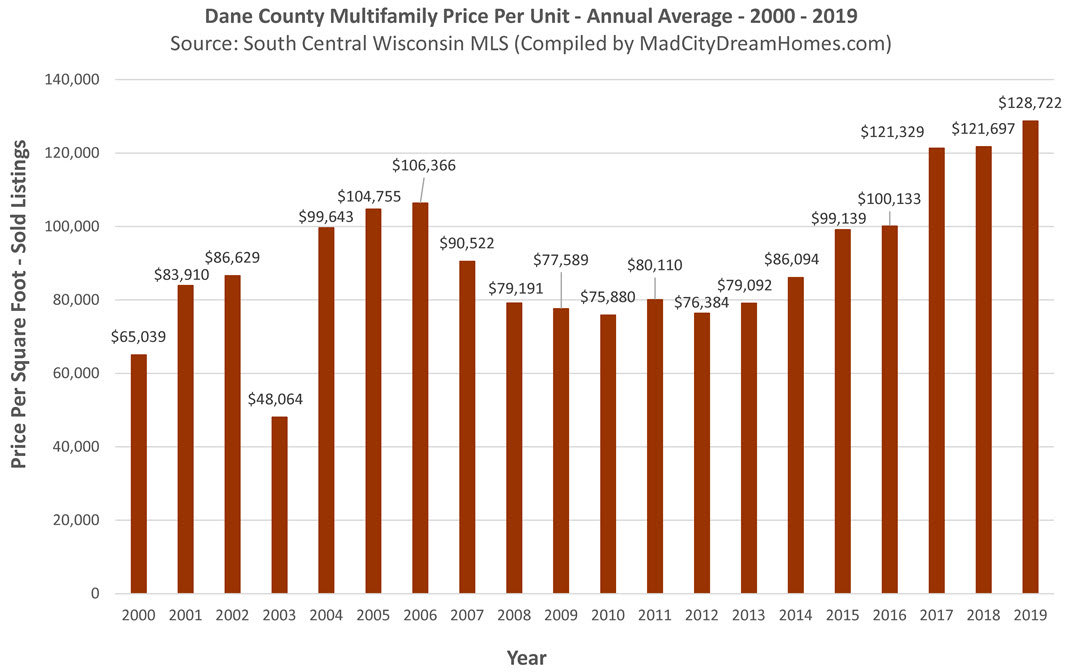

On an annual basis, the multifamily price per unit ended the 2019 sales year at $128,722 - the highest ever.

Dane County Multifamily Inventory - June, 2020

The table below is a snapshot of the local rental property market taken on June 24th. Overall, there are only 1.6 months of supply available for sale in the Dane County multifamily real east market. Also, 36% of all Madison area multifamily listings have an accepted offer. These stats indicate a high demand/low supply market.

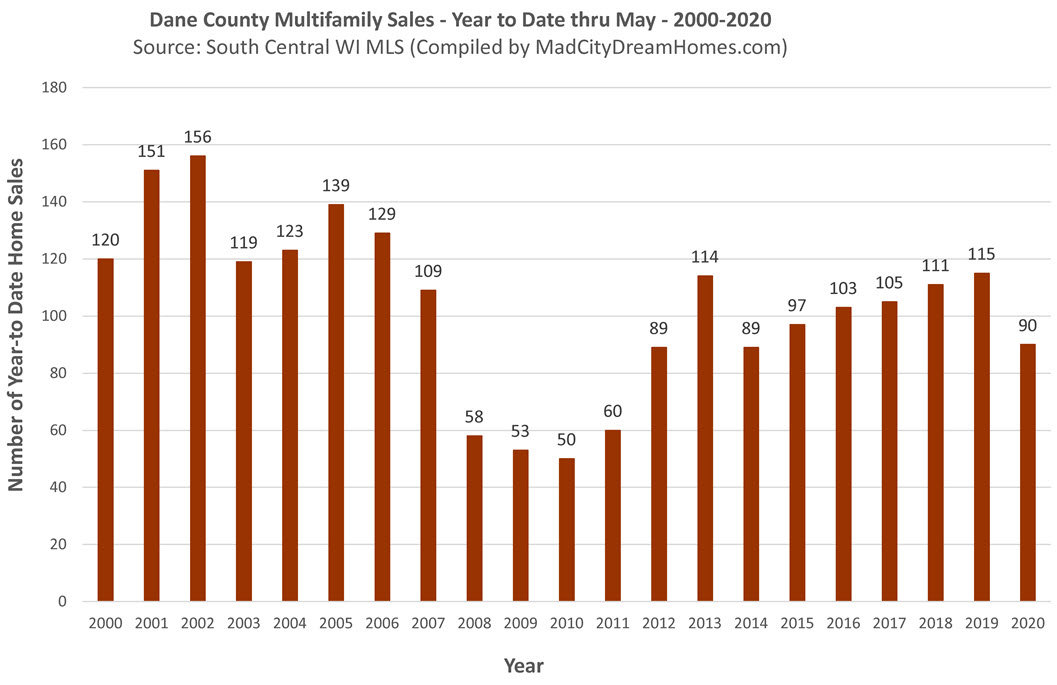

Dane County Multifamily Sales - May, 2020

So far this year, investment properties are selling at the same pace as last year. Year-to-date through May, a total of 90 Dane County multifamily listings sold via the South Central Wisconsin MLS. Note, sales would be higher if more inventory were available on the open market. Fewer properties are being listed for sale this year due to the COVID-19 pandemic.

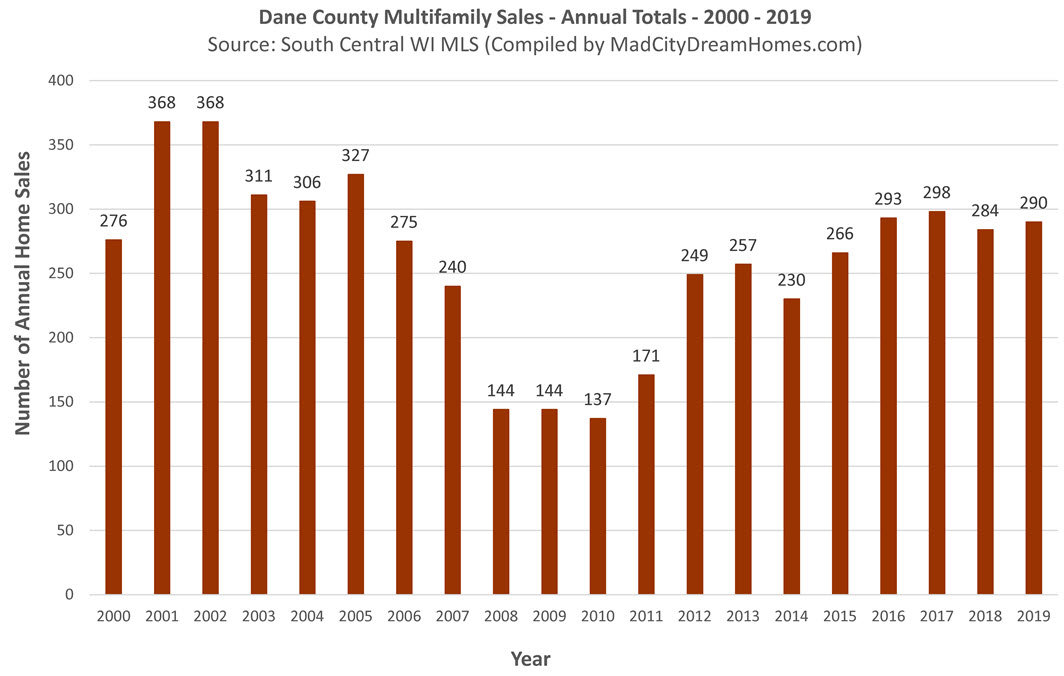

On an annual basis, a total of 290 multifamily listings sold via the MLS in 2019. Sales plateaued due to a scarcity of listings on the open market.

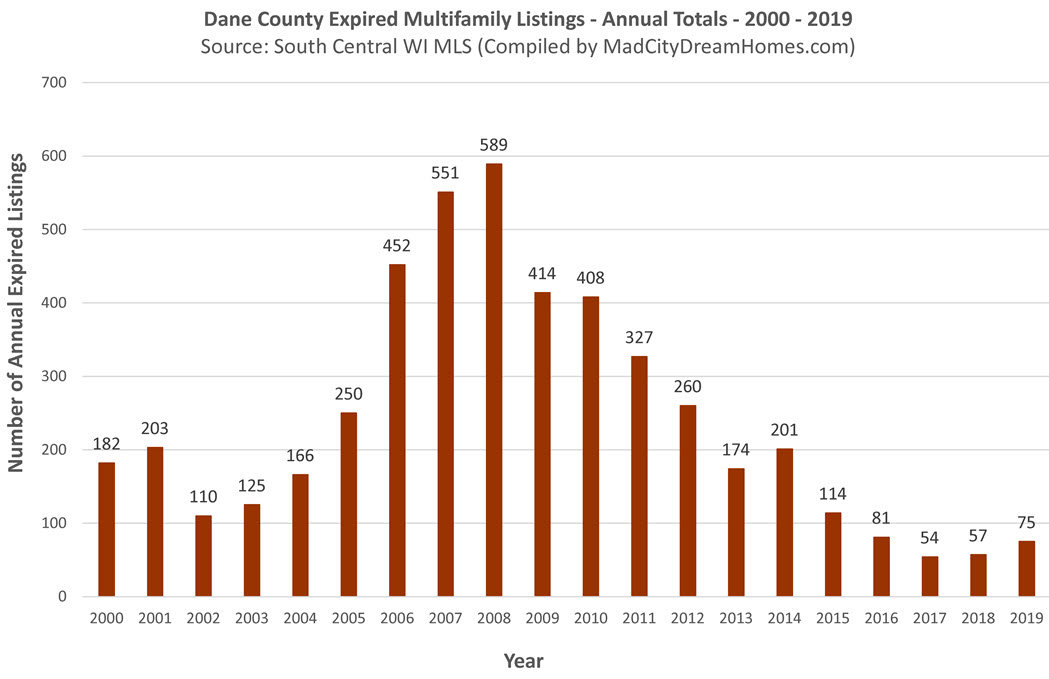

Dane County Expired Multifamily Listings - May, 2020

A total of 33 Dane County income property listings expired year-to-date through the month of May, which is one of the lowest expired listing totals on record. This is one of many indicators which point to a good seller's market for investment properties in the Madison area.

A total of 75 rental property listings expired in 2019 - the third lowest expired listing total on record.

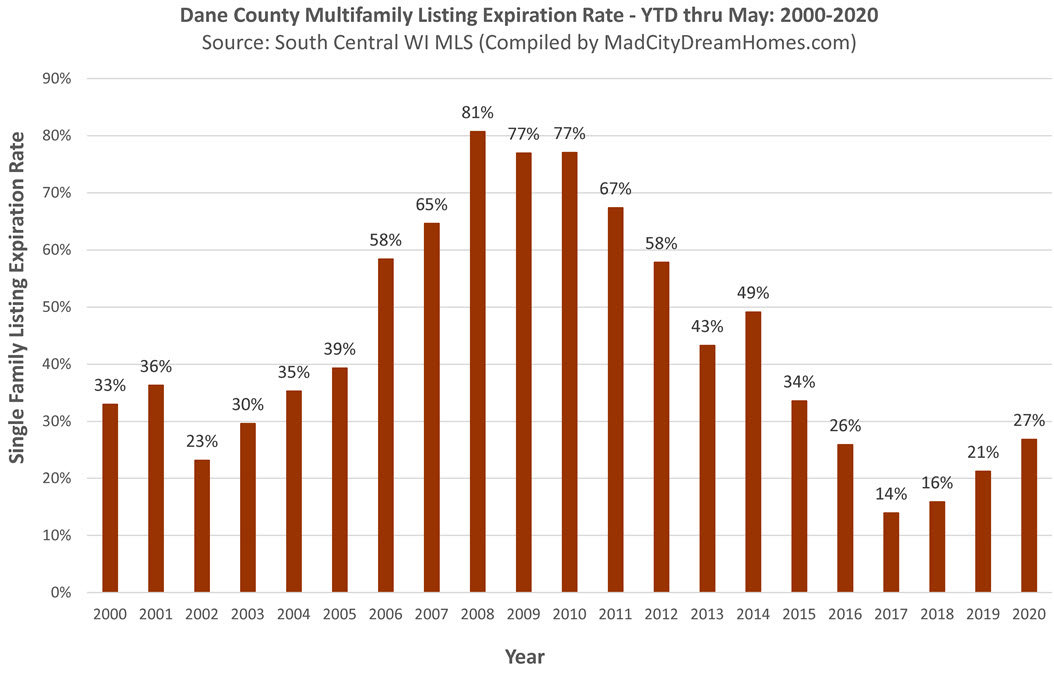

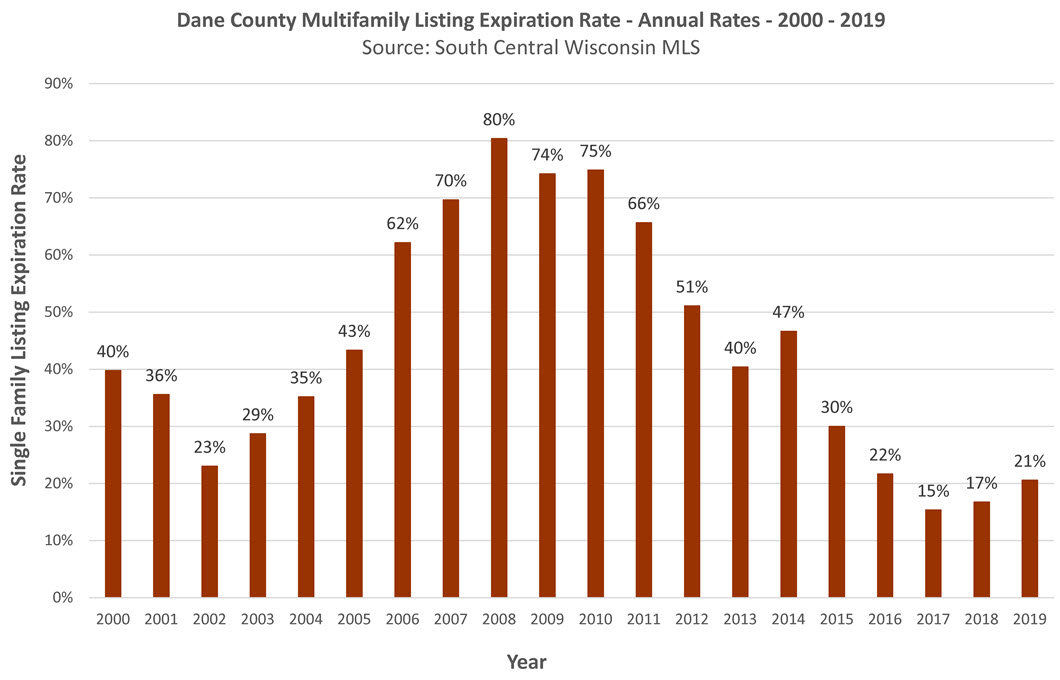

Income Property Expiration Rate - May, 2020

The year-to-date expiration rate for Madison area multifamily listings is only 27%. This represents the sixth lowest year-to-date expiration rate on record. In contrast, the 2008 expiration rate was 81%.

The annual income property listing expiration rate in 2019 was only 21%. This was the third lowest expiration rate on record.

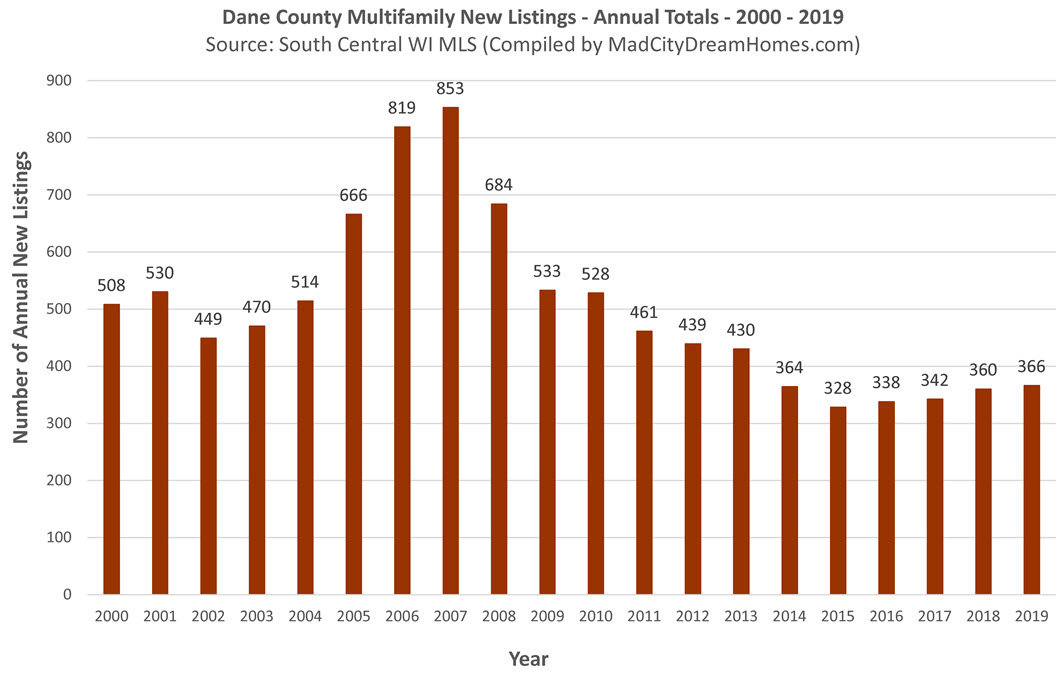

New Dane County Income Property Listings - May, 2020

Year-to-date, only 108 multifamily listings were posted to the MLS through the month of May - the lowest on record. A low supply of fresh incoming listings has helped to shape a seller's market for multifamily properties in the Madison area.

A total of 366 income property listings were posted to the MLS in 2019. This was slightly above the record low for the Dane County market.

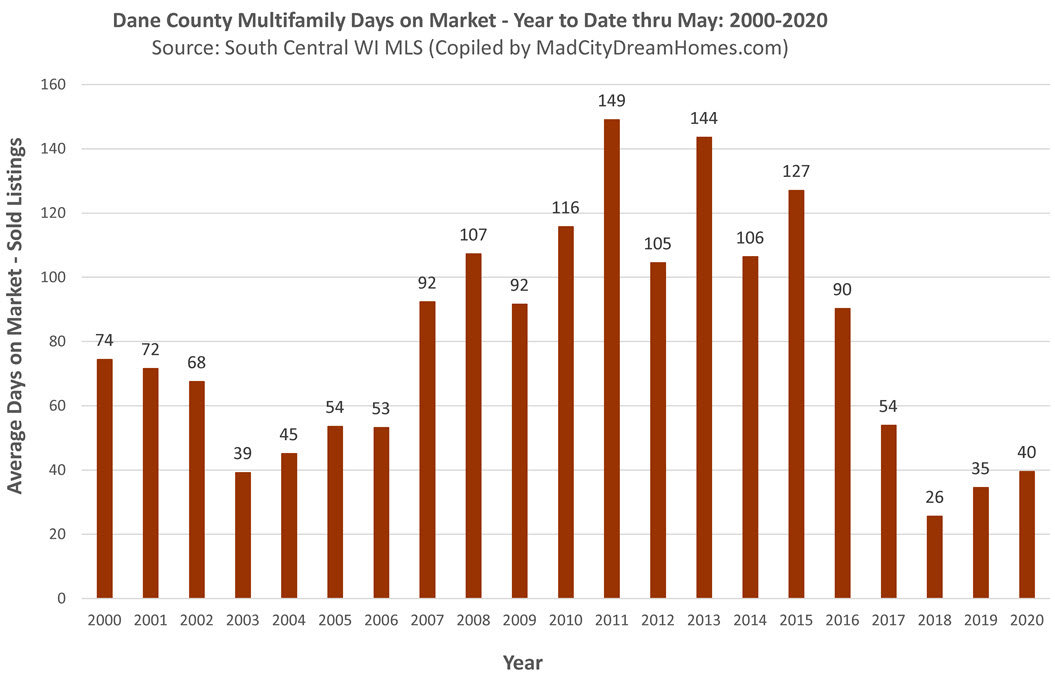

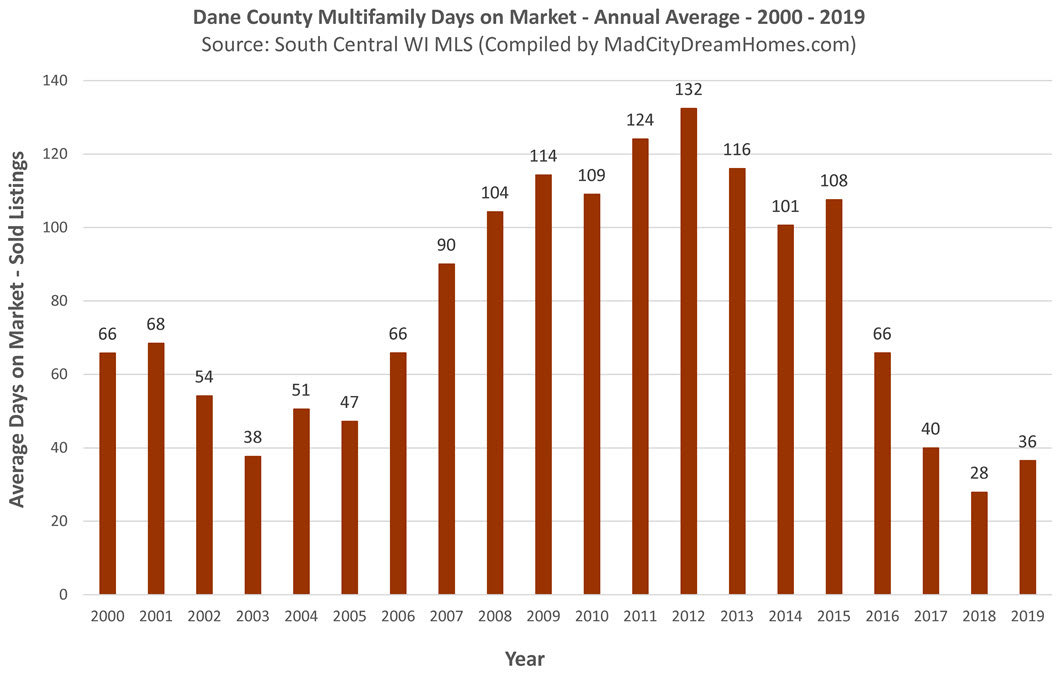

Dane County Multifamily Days on Market - May, 2020

Year-to-date through May, the average days on market for Madison area rental properties was 40 days - up from last year's 35 days.

The annual average days on market for all of 2019 was only 36 days - which was the second lowest annual average dating back to the year 2000.

About the Author

Dan Miller is a licensed real estate salesperson with RE/MAX Preferred in Madison, Wisconsin. Contact Dan with any questions you have about buying, selling or investing in the Dane County area. This market report will be updated several times throughout the year. Check back often for an update on the latest trends in the local investment property market.