Nonprofit Spotlight: Wisconsin Microfinance positively impacts the developing world

Posted by Samantha Haas on Thursday, July 29th, 2021 at 3:09pm.

In January 2010, Haiti was the site of an earthquake that killed over 300,000 people and displaced millions of Haitians. Gergens Polynice, a student at UW-Madison, was from Port-au-Prince (the capital of Haiti and also the epicenter of the earthquake) and had spent the holidays at home. Although his family was not hurt, the needs of the Haitian community were immediate. One of his professors, Tom Eggert, taught a class on sustainable development and organized students in the class to help those in Haiti who were left without places to stay, places to work, and places of safety. “This was one of the first natural disasters you could donate to on your phone via text, and the international community arrived with food, medicine, shelter, and water. But my students wanted to raise money directly for the people affected,” Eggert said.

In January 2010, Haiti was the site of an earthquake that killed over 300,000 people and displaced millions of Haitians. Gergens Polynice, a student at UW-Madison, was from Port-au-Prince (the capital of Haiti and also the epicenter of the earthquake) and had spent the holidays at home. Although his family was not hurt, the needs of the Haitian community were immediate. One of his professors, Tom Eggert, taught a class on sustainable development and organized students in the class to help those in Haiti who were left without places to stay, places to work, and places of safety. “This was one of the first natural disasters you could donate to on your phone via text, and the international community arrived with food, medicine, shelter, and water. But my students wanted to raise money directly for the people affected,” Eggert said.

After raising $3,000, the class tried to find an organization that could distribute the money to help Haitians -- some of the poorest people in the Americas -- get back on their feet again, especially when so many businesses were destroyed and jobs were lost. When they couldn’t find such a group, Eggert tapped into his teaching background of microfinance theory and sustainable development and decided to found an economic development nonprofit, called Wisconsin Microfinance.

The mission of Wisconsin Microfinance is to provide small loans to aspiring entrepreneurs in the developing world so as to change the future of their family and their community. The volunteer-run nonprofit is based in Madison and rooted in the Wisconsin Idea, which “holds that university research should be applied to solve problems and improve health, quality of life, the environment, and agriculture for all citizens of the state.” Over the last decade, the nonprofit has developed programs in Barreau Michel and Leogane, Haiti and on the island of Bohol, Philippines, after the country was impacted by an earthquake and typhoon.

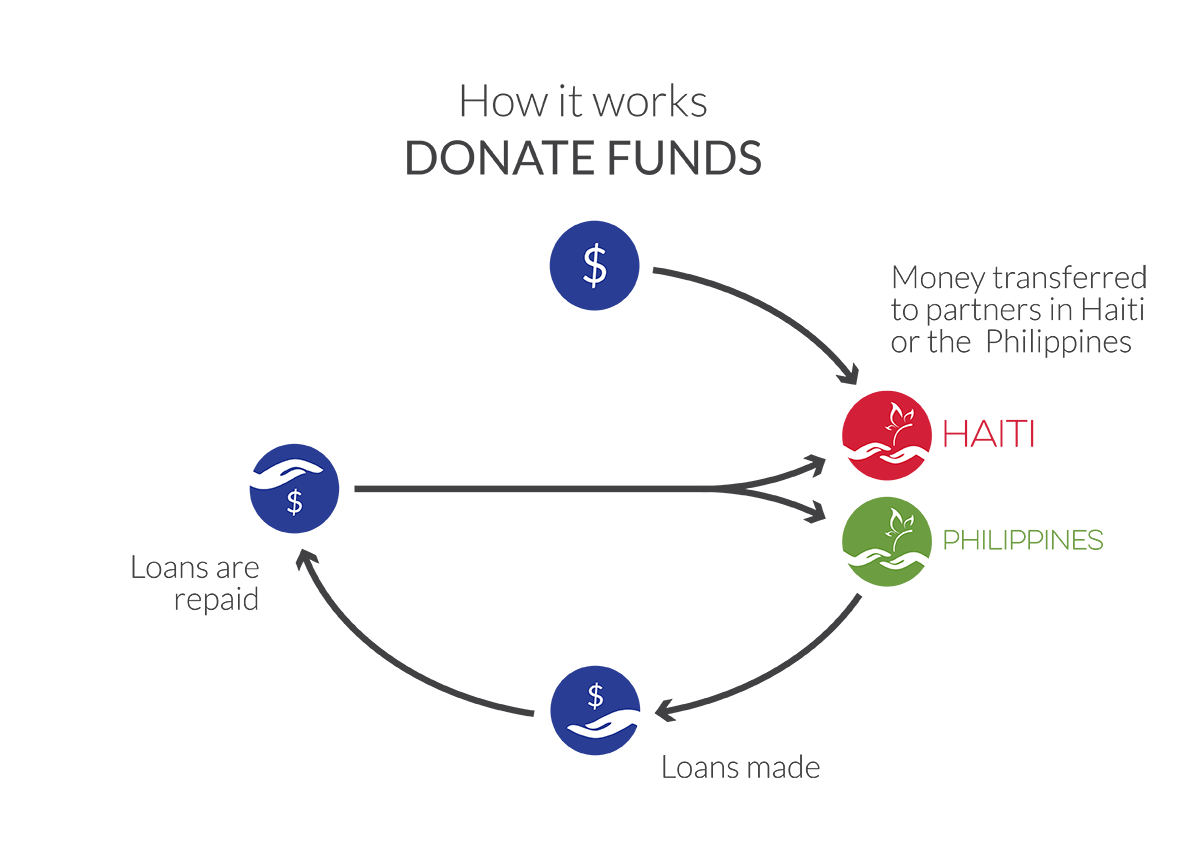

Through fundraising efforts (90% of each dollar donated is turned into loans), Wisconsin Microfinance provides the capital to its on-the-ground partners in these countries, who then select a group of candidates (80% of whom are women), educate borrowers on financial responsibility, distribute microloans (generally between $35-$100), and collect loan payments. Using the Grameen Bank model, founded by Nobel Prize winner Muhammad Yunus on the belief that “the very poor have unlimited potential, and unleashing their creativity and initiative helps to end poverty,” the nonprofit hopes to address inequality, capital restraints, and gender disparities across the globe.

Through fundraising efforts (90% of each dollar donated is turned into loans), Wisconsin Microfinance provides the capital to its on-the-ground partners in these countries, who then select a group of candidates (80% of whom are women), educate borrowers on financial responsibility, distribute microloans (generally between $35-$100), and collect loan payments. Using the Grameen Bank model, founded by Nobel Prize winner Muhammad Yunus on the belief that “the very poor have unlimited potential, and unleashing their creativity and initiative helps to end poverty,” the nonprofit hopes to address inequality, capital restraints, and gender disparities across the globe.

Prior to the pandemic, Eggert and some students had been able to travel to these countries to develop relationships and gather case studies about how these microloans have made a major difference in the lives of the entrepreneurs, their families, and their communities. “Because of our microloan presence in Haiti, a school and health clinic opened in the community we were active in,” Eggert said. Some examples of how microloans were used by entrepreneurs include buying small animals and seeds to then grow, make products, and sell at markets in Haiti, and buying nets and boats to sustain fishing businesses in the Philippines.

Prior to the pandemic, Eggert and some students had been able to travel to these countries to develop relationships and gather case studies about how these microloans have made a major difference in the lives of the entrepreneurs, their families, and their communities. “Because of our microloan presence in Haiti, a school and health clinic opened in the community we were active in,” Eggert said. Some examples of how microloans were used by entrepreneurs include buying small animals and seeds to then grow, make products, and sell at markets in Haiti, and buying nets and boats to sustain fishing businesses in the Philippines.

Both countries have been hit hard by COVID-19, and currently the virus is resurgent, with less than 3% of the population vaccinated in the Philippines and close to none in Haiti. Alen Amini, Wisconsin Microfinance executive director, and Annalise Ebert are helping to organize upcoming fundraising events for Wisconsin Microfinance, including a fall gala that will directly benefit the Haiti program. “Our Haiti program has been thriving since we relaunched it, and the political situation in Haiti keeps increasing the need for microfinance services in the country,” Ebert said. Eggert added that the event will feature videos from both countries and interviews from folks who’ve gotten loans and what a difference the programs make. “We’re committed to continuing to improving lives, one by one,” he said.

Haiti Success Story: Naureen

By: Annalise Ebert

In Haiti, one of our original borrowers, Naureen, is a mother of two children who were 4 and 7 years old when she took out her first Wisconsin Microfinance loan. Naureen’s husband lost his job after the destruction of the earthquake, so they had no income to support their household which included her husband's parents. Naureen used her microloan to buy a pig and forage. Her pig had piglets so she was able to sell some of the piglets and raise others. The income from the sale of the piglets allowed her to support her family. She used the extra income earned to send her 7-year-old daughter to school for the first time. Her daughter had never been to school, and Naureen herself had never been to school, but Naureen saw the value of education and was able to give her daughter the opportunity to go to school, which she couldn’t afford even when her husband did have a job. This is a big step considering only 57% of women in Haiti are literate and most girls in Haiti only attend school until they are 7 years old. It is likely that Naureen’s economic and personal success along with her daughter’s education will uplift their family for generations to come and have a positive impact on their community.

Philippines Success Story: Jocelyn

By: Annalise Ebert

Jocelyn is one of our borrowers in Pitogo Island, Bohol, Philippines. She has been a fish vendor for over 12 years but her stock relied solely on what her husband, a fisherman, could catch. She took out a Wisconsin Microfinance loan and was able to begin buying from other suppliers and diversifying the products she sold. Her plan was a success and now she sells fish, fruits, and vegetables. The extra income she has generated from growing her business has allowed her to put both of her children through school, start a savings account, and afford insurance for her business.

Ways to support Wisconsin Microfinance

-

Make a tax-deductible donation at wisconsinmicrofinance.com/take-action/donate/.

-

Attend the Madison Mallards game on August 10th in the Nonprofit Spotlight Section 201 using ticket promo code wimf and participate in the 50/50 raffle.

-

Stay tuned for more details on the Wisconsin Microfinance Fall Gala in November at Harvest to benefit the Haiti program.

- Follow the organization on Facebook and spread the word!