Are Zestimates and Assessed Values Accurate?

Posted by Dan Miller, REALTOR on Friday, January 16th, 2015 at 6:26am.

Zillow is a tremendously popular website with a ton of bells and whistles. One of the more popular features of the site is the "Zestimate", which Zillow uses to approximate a home's market value. We speak to many sellers every year about the market value of their property, and very often they are well aware of their Zestimate. People ask, "Is my Zestimate accurate?" Very often the answer is no, because the Zestimates are grossly overstated (see our data toward the bottom of this post).

Zillow is a tremendously popular website with a ton of bells and whistles. One of the more popular features of the site is the "Zestimate", which Zillow uses to approximate a home's market value. We speak to many sellers every year about the market value of their property, and very often they are well aware of their Zestimate. People ask, "Is my Zestimate accurate?" Very often the answer is no, because the Zestimates are grossly overstated (see our data toward the bottom of this post).

Another common discussion point with sellers is their property's assessed value. We're all aware of our own property's assessment. It's used to calculate our annual tax bill. But is there any relationship between a property's assessed value and it's true market value? Can and should we use the assessed value to price a home? Let's take a closer look at assessed values and Zestimates below.

Why Assessed Values and Zestimates Don't Work

Market values are determined by what ready and able buyers are willing to pay for a home. Buyers assign value by viewing and closely examining the properties that are available for sale in their market. They compare the amenities, finishes, floor plans, functionality, size, and quality of each home. Buyers review real estate condition reports. They also evaluate the location of each property in relation to the local parks, schools, and shopping districts. Before they write their offer, they work with their agent to evaluate all of the recent sales in the area. They also assess the likelihood of whether or not the property they are writing on will receive competing offers. They process all of this info (and more) before they submit their offer to purchase.

Assessed values and Zestimates don't work because they are based on formulas, and formulas can't process the type of information that a buyer does. For example, formulas can't discern the condition and quality of a home, how a floor plan affects a home's value, or how a property's proximity to a large apartment building impacts its worth.

Another weakness of formulas is they are static in nature. Assessed values in Madison are updated annually using data from the year before. The real estate market, on the other hand, is always in a state of flux. Even if a property's assessed value is accurate, it soon becomes outdated because the real estate market is constantly changing.

Buyers are able to stay on top of market changes because they are always working in the present. Buyers working with a buyer agent know when new listings arrive on the scene, when prices change, when properties receive accepted offers, and when houses sell. They know whether or not their target neighborhood is located in a hot market or a cold market.

Dangers of Using Zestimates and Assessed Values

As our data shows, as well as more comprehensive data from the Washington Post, the Zestimate doesn't provide a reliable formula for pricing a home. Yet time and time again we see sellers pricing their home based on a formula. It's human nature. We put our faith in the formula that supports the price we want, rather than using the information that shows what the market will bear. This leads to over-pricing, longer marketing times, and frustration. As we've covered before, over-priced homes net less at the closing table than the properties that are priced properly from the start.

More Common Pricing Mistakes

There are other ways that sellers can get their pricing wrong. These include the following:

- Placing too much emphasis on the price per square foot

- Going with the agent who tells you what you want to hear, instead of heeding the advice of the agent who tells you what you need to hear

- Pricing based on your mortgage balance

- Assigning too much value to your home maintenance and home improvements

- Using a previous appraisal

- Ignoring seasonality

- Ignoring school attendance areas

We'll be covering these common pricing mistakes in more detail soon.

The Best Way to Price your Home

The best way to price your home is to ask your real estate agent to complete a comparative market analysis (CMA) for you. A good market analysis will analyze your neighborhood market along all of these dimensions:

- Recent sales in the neighborhood

- Current listings with accepted offers

- Current listings without accepted offers

- The months of inventory (or absorption rate) in your neighborhood

- The effect of seasonality on your pricing

We'll cover the steps that go into a good market analysis in the near future.

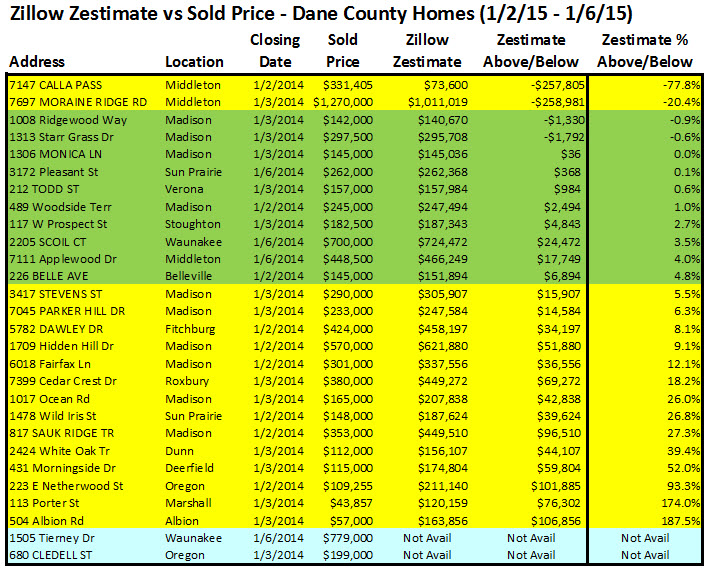

So how accurate are those Zestimates?

To answer this question, we pulled the first 28 Dane County single family home sales recorded during the 2015 calendar year - courtesy of the South Central Wisconsin MLS. For each transaction, we compared the property's sold price to its Zillow estimated value. Here's a summary of results.

- Twenty-six of the 28 properties had a Zillow estimated value. Two of the properties did not.

- Twenty-two of the 26 Zestimates were higher than the sold price (85%). Only 4 Zestimates were below (15%).

- The largest discrepancy on the low side underestimated true market value by more than $258,000.

- The largest discrepancy on the high side overestimated true market value by more than $106,000.

- Only ten of the Zestimates were within plus or minus 5% of the selling price (38%). See the properties shaded in green below.

- The remaining 62% of the Zestimates varied from the selling price by more than 5% (see the properties shaded in yellow below). Although two of the Zillow estimates underestimated market value by more than $250,000, the Zestimates for this group of properties were strongly biased toward over-estimating true market value.

- Overall, the Zestimate median variance from true market value was a whopping $35,377.

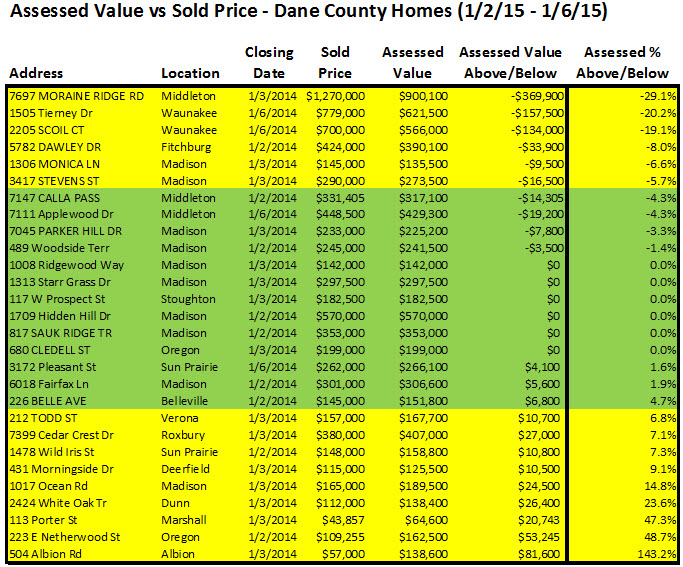

How accurate are assessed values?

We took a second look at the same transactions outlined above. For each transaction we compared the assessed value from Access Dane to the actual selling price of each property. Here are the results.

- Eighteen of the 28 transactions had an assessed value at or above the sales price (64%). Ten of the assessed values were below (36%).

- The biggest discrepancy on the low side underestimated true market value by more than $369,000.

- The biggest discrepancy on the high side overestimated true market value by more than $81,000.

- Thirteen of the assessed values were within plus or minus 5% of the selling price (46%). See the properties shaded in green below.

- The remaining 54% of the assessed values varied from the selling price by more than 5% (see the properties shaded in yellow below).

- Overall, the assessed value median variance from true market value was $10,750. By and large the assessed value was more accurate than the Zillow Zestimate. However, neither the Zestimate nor the assessment served as a reliable list price for most of the homes in our sample.